WHITE PAPER

Competitive Comparison for Insider List Management: Software vs. Manual Methods

This white paper dives into how a dedicated insider list management solution can transform the way you handle insider list workflows, trading windows, and broader compliance tasks under the Market Abuse Regulation (MAR).

The comparison framework explores the main tasks arising from manual MAR compliance, highlighting the associated time and resource expenditure. Finally, it compares these expenditures to those encountered when opting for an automated solution, like InsiderLog, and provides insight into the Return on Investment (ROI) by factoring in the average wages of compliance officers executing these tasks.

Download your ebook

Fill out the form to get access

What else can you expect from this white paper?

Common manual tasks related to MAR compliance

Comparison on time spent executing tasks manually vs. automating them

Additional indirect benefits from digitising your insider list management

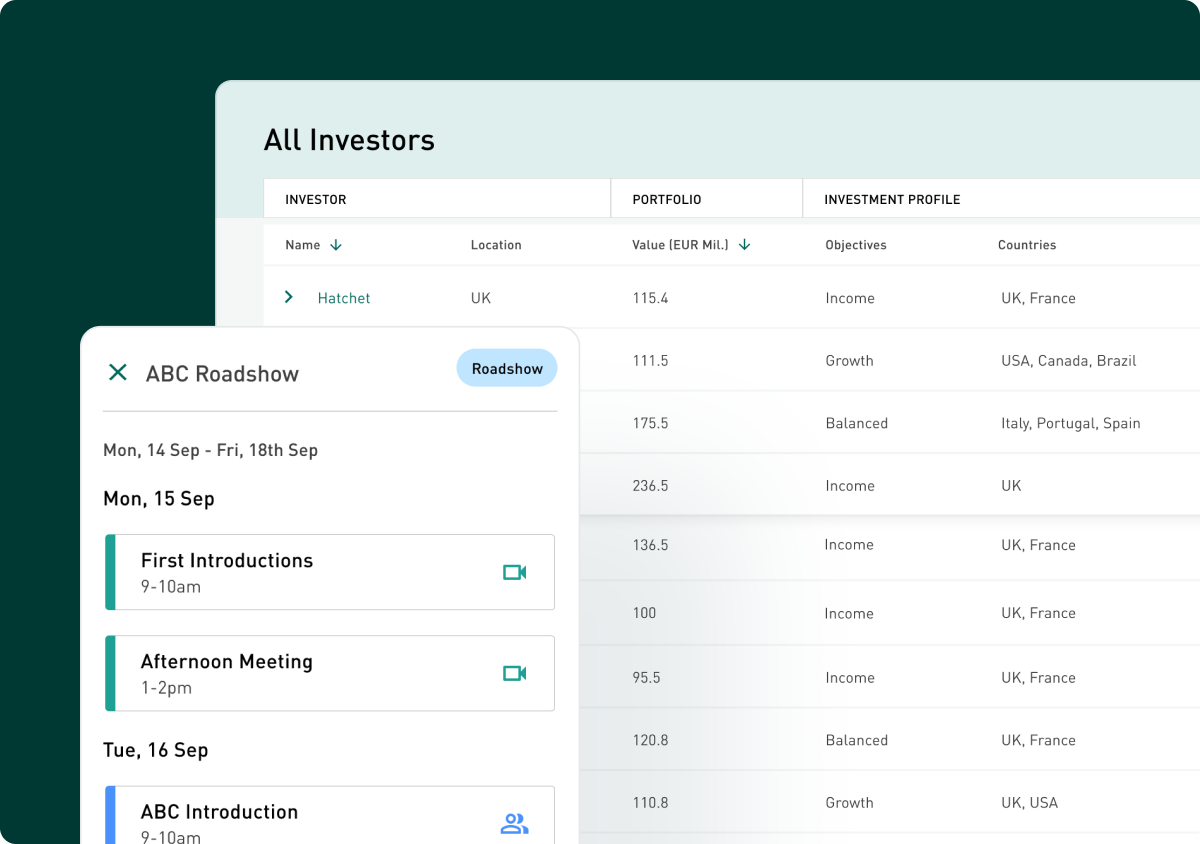

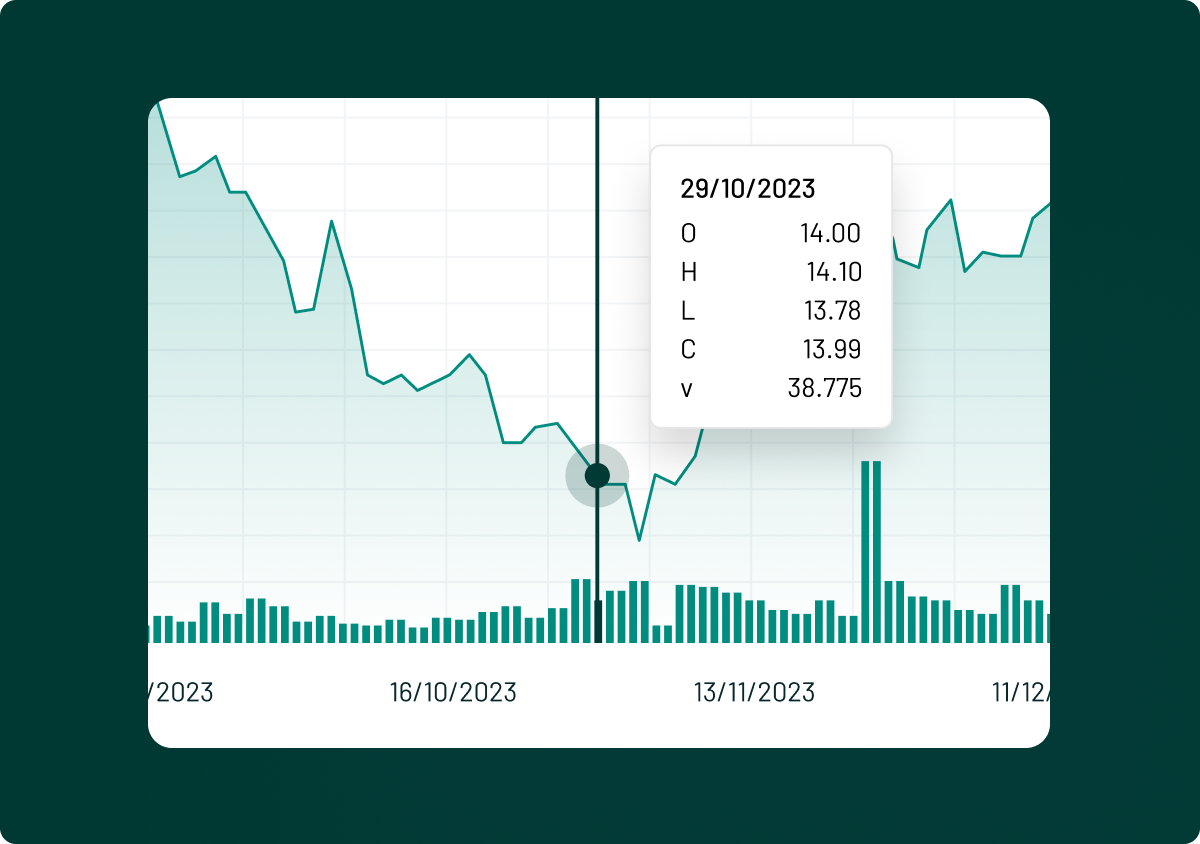

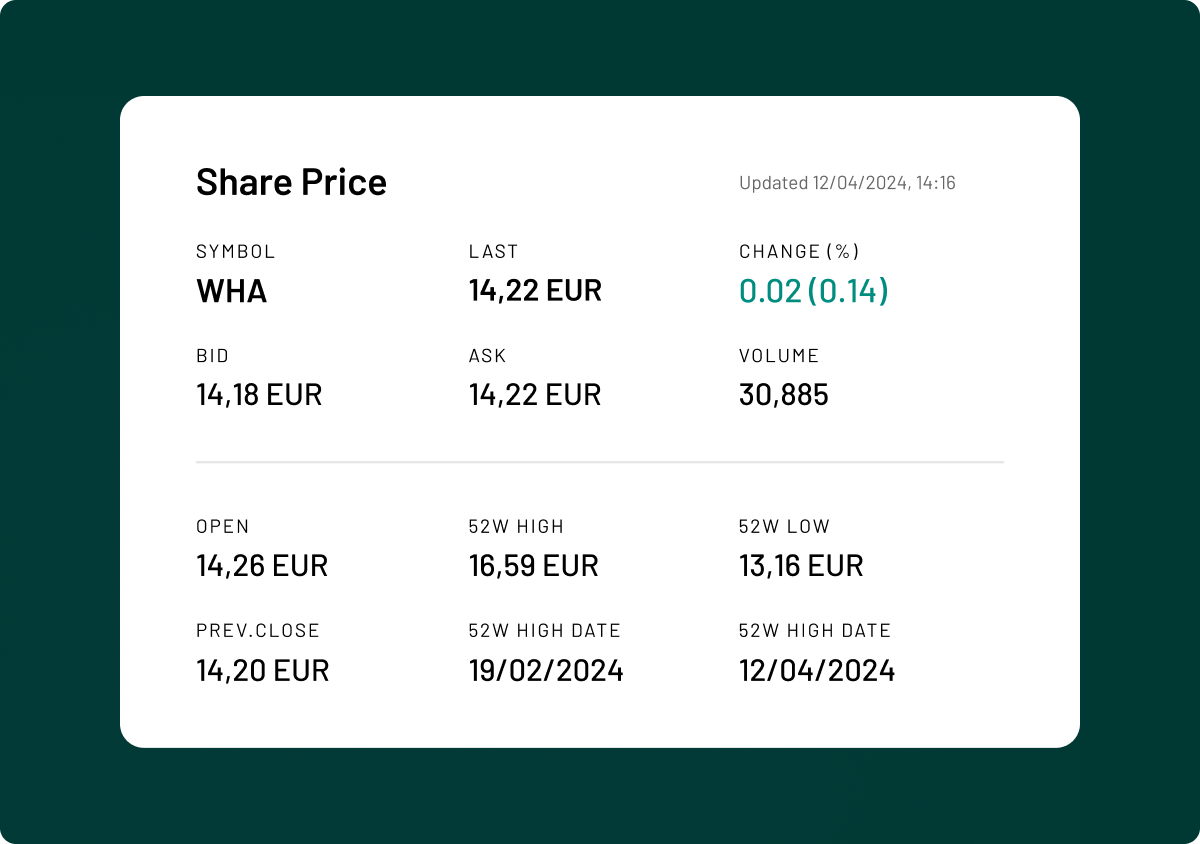

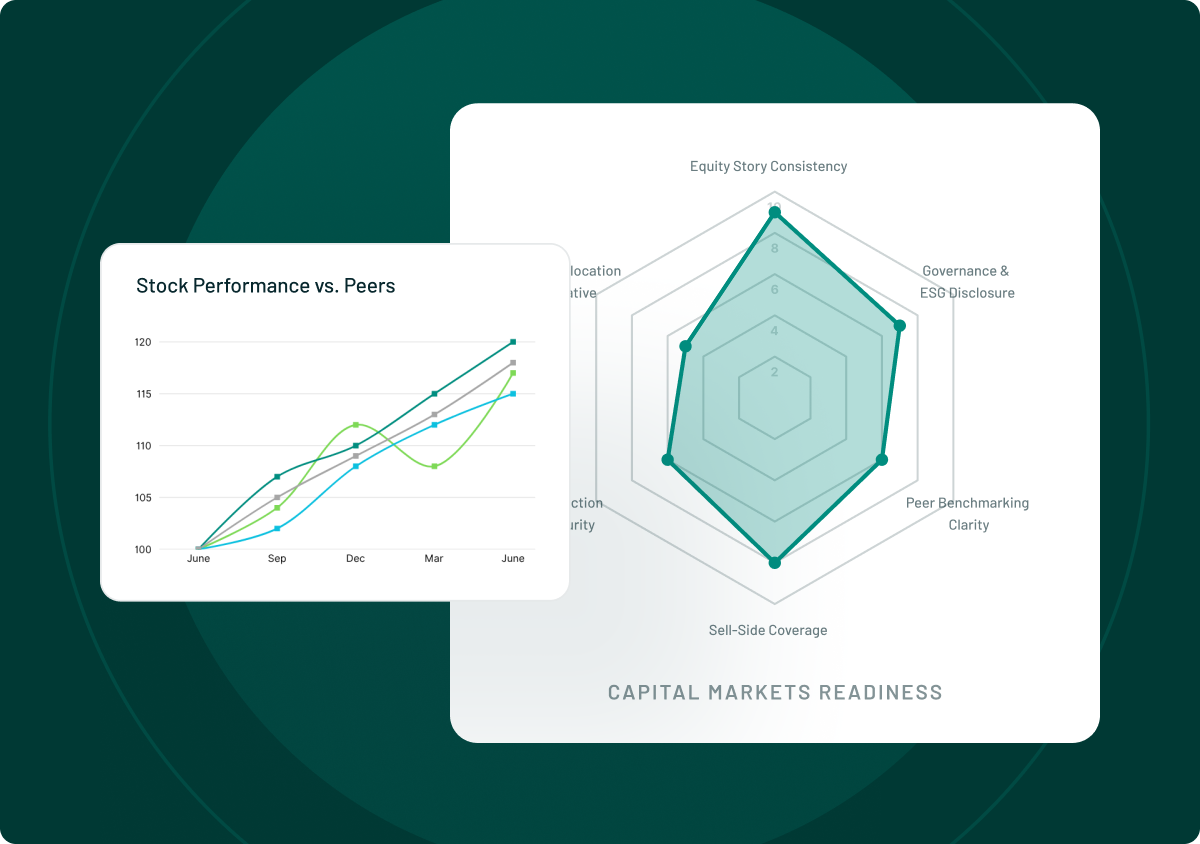

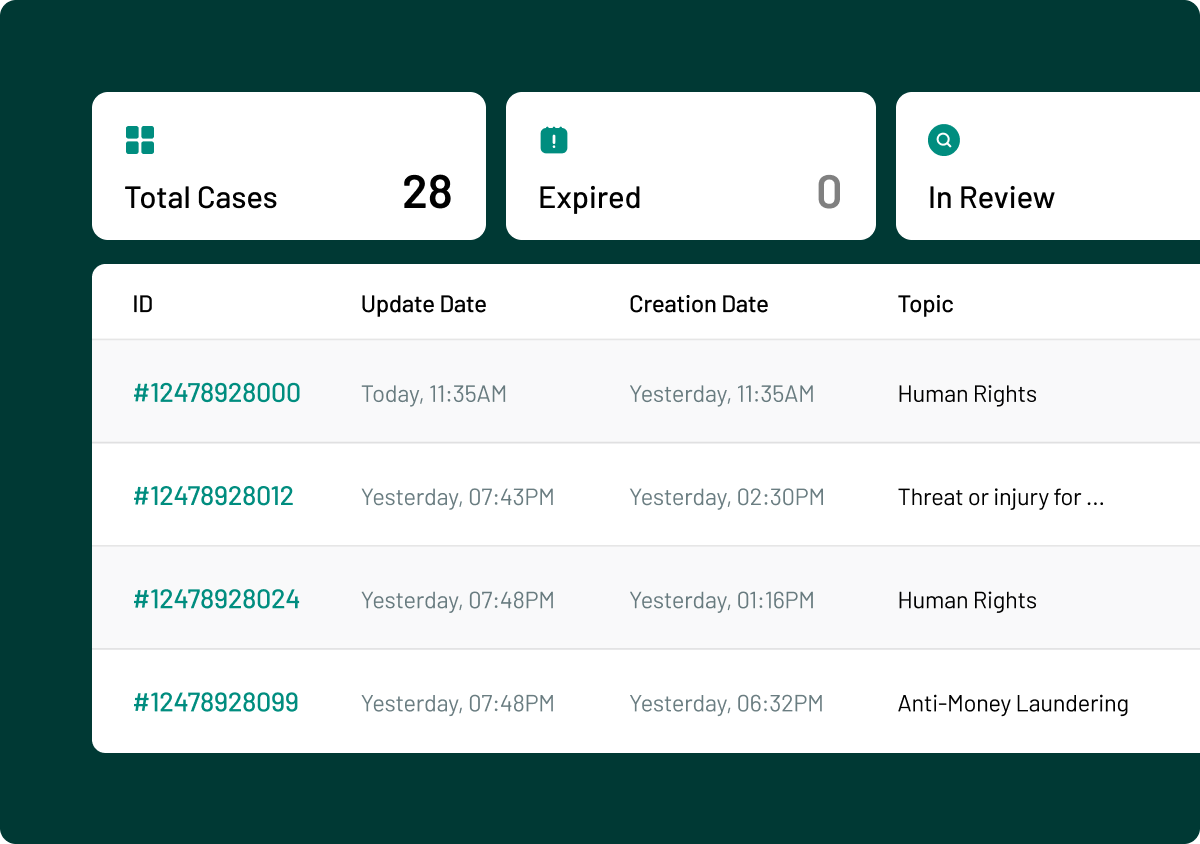

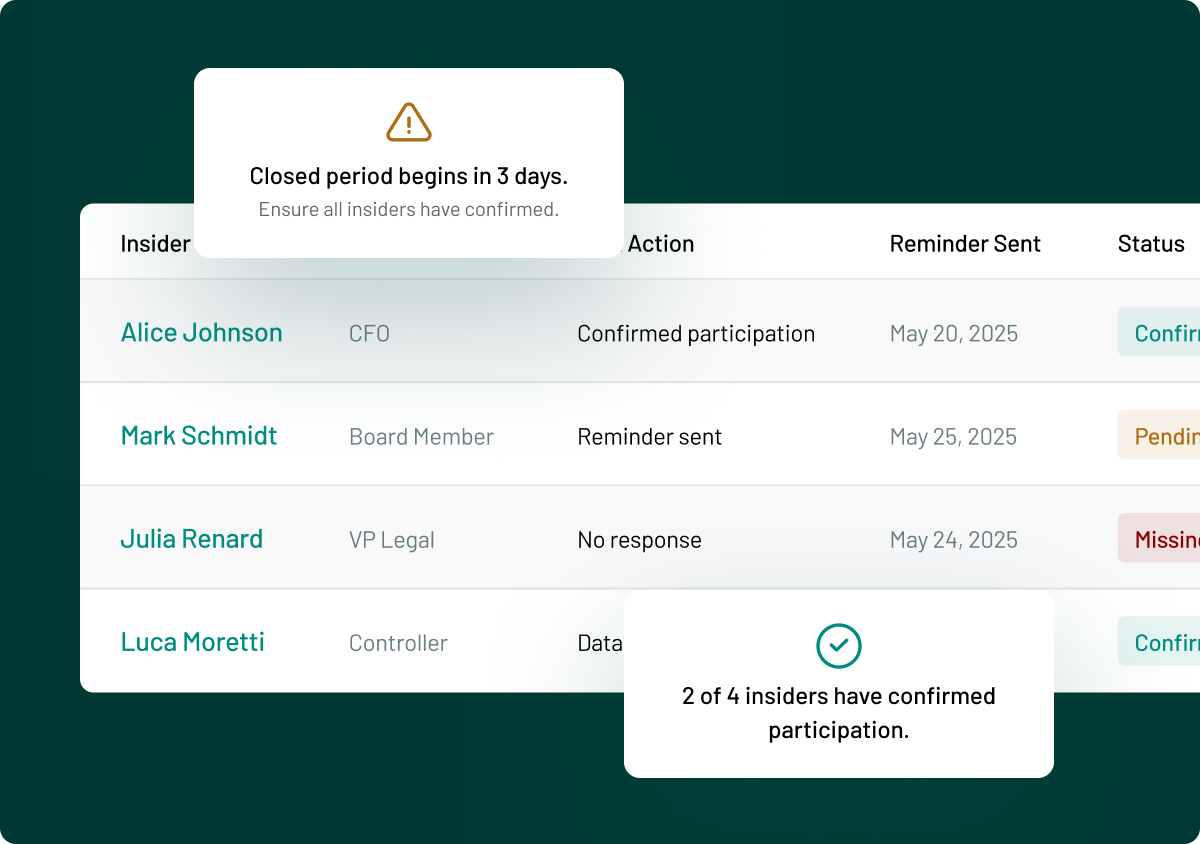

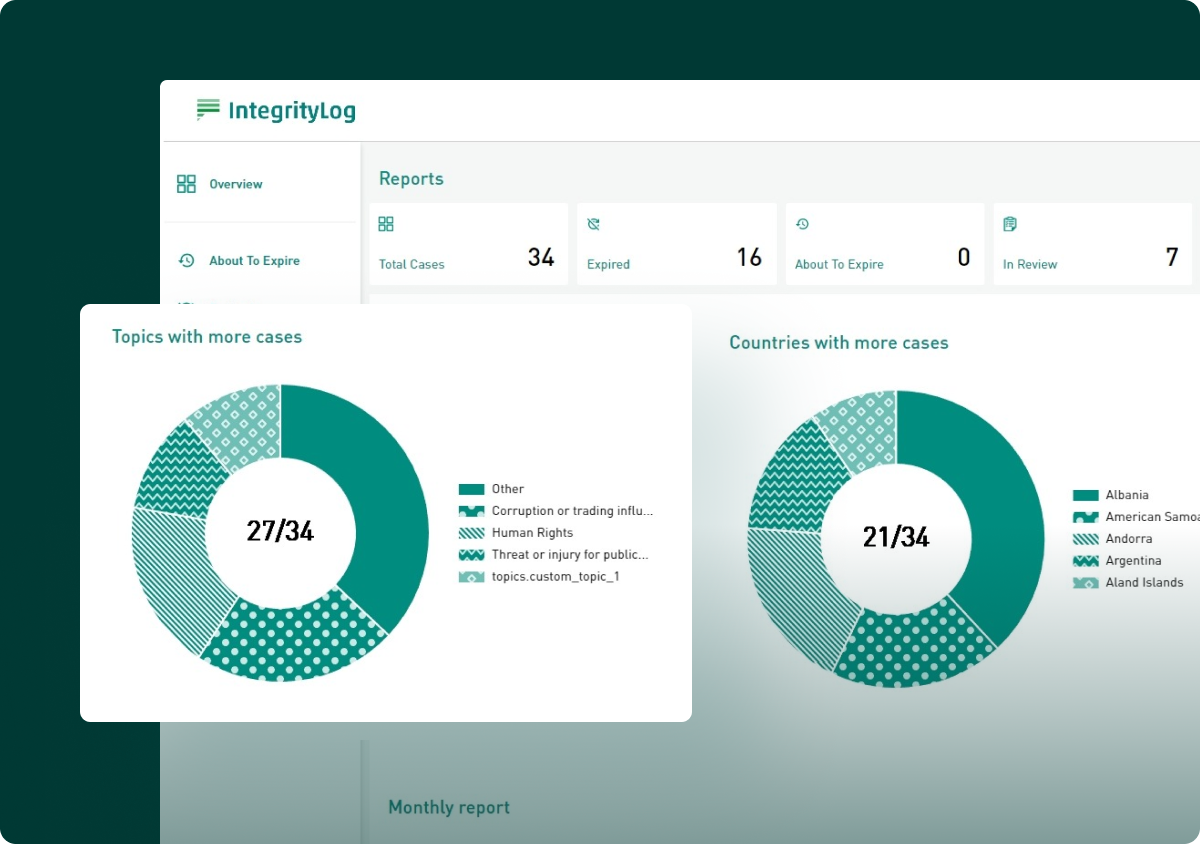

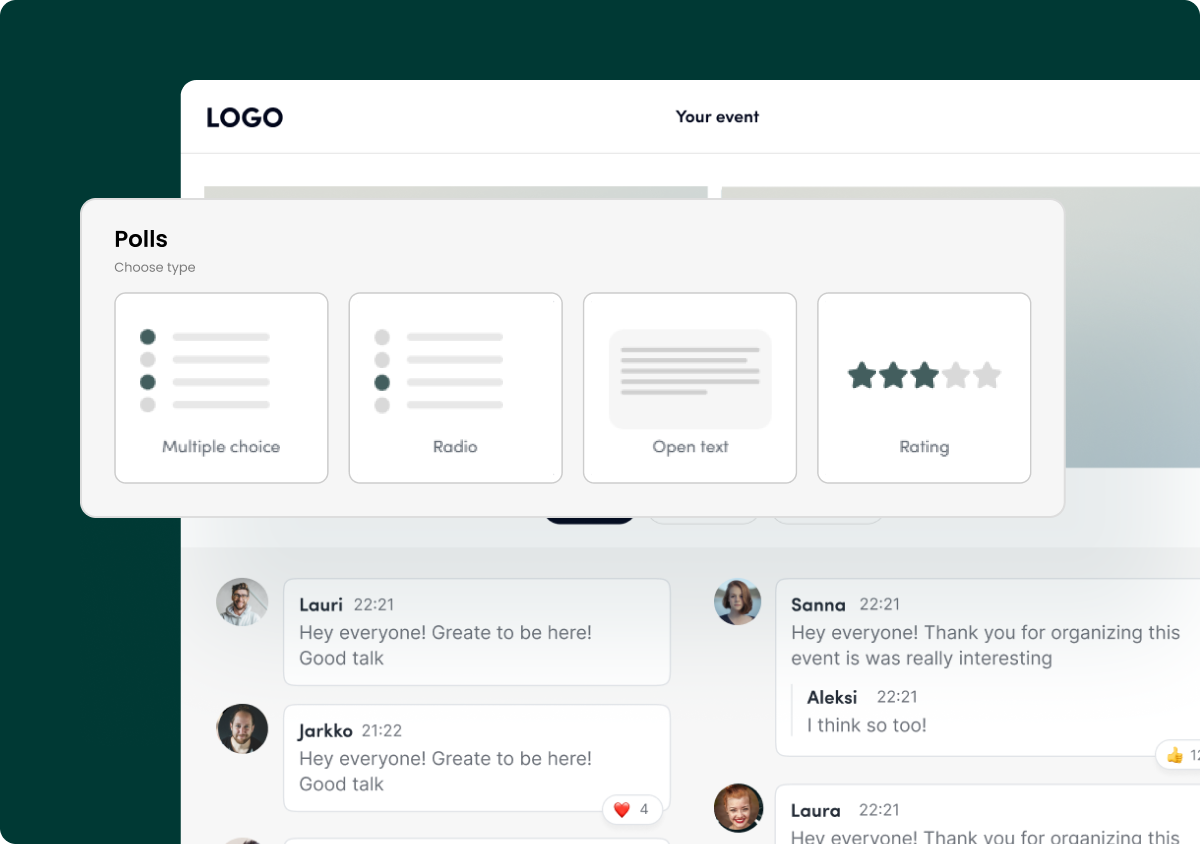

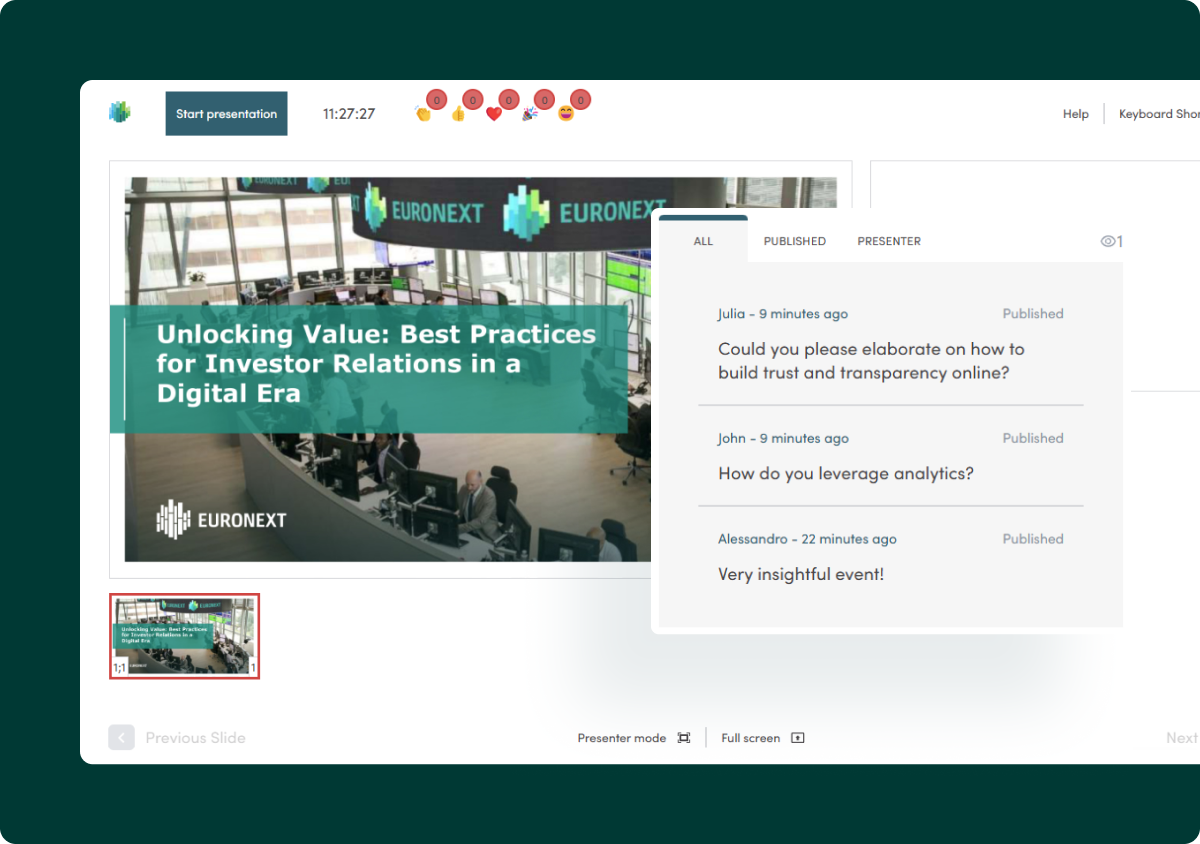

Examples of an insider list software used by 1000+ companies in Europe

Get your free copy of the white paper now

DOWNLOAD NOW

FAQ

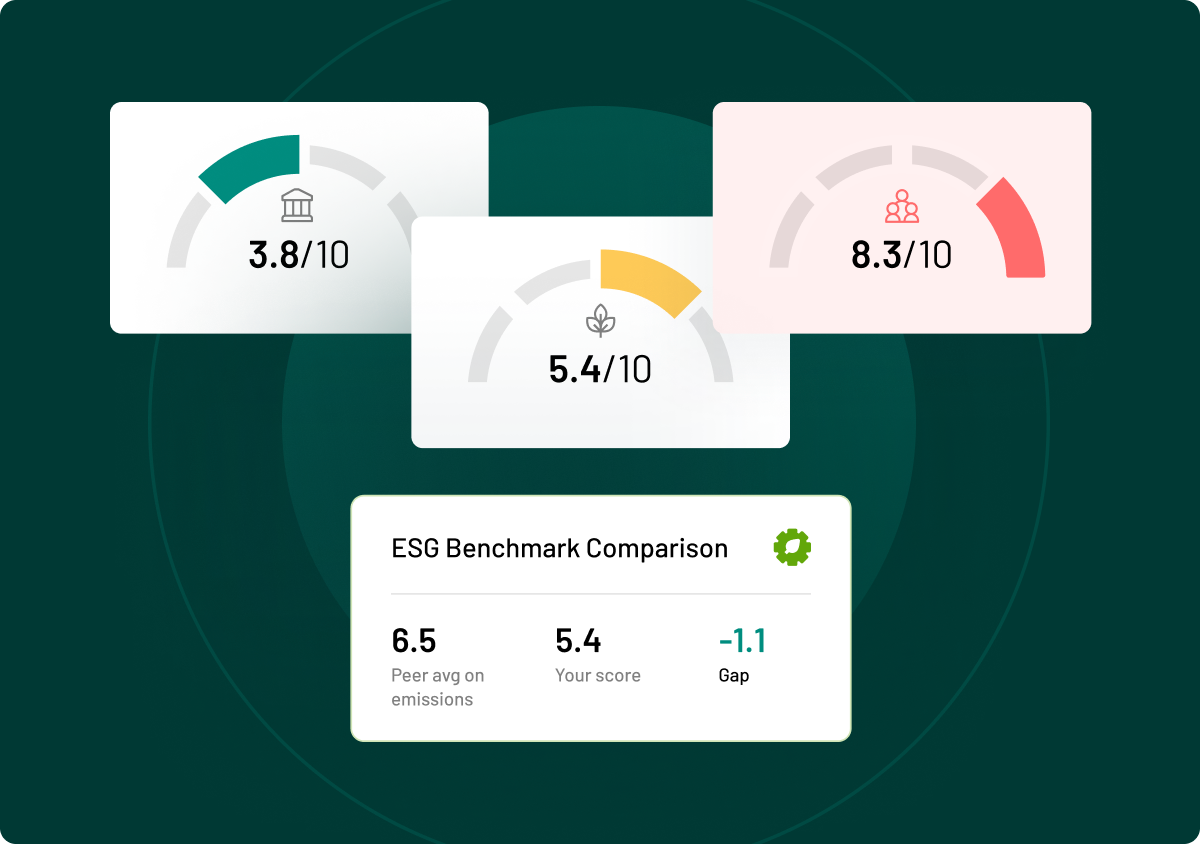

The Market Abuse Regulation (MAR) is a crucial piece of EU legislation designed to maintain fair and transparent financial markets. It does this by preventing insider dealing, market manipulation, and the unlawful disclosure of inside information. MAR applies to all listed companies, requiring them to put in place robust compliance procedures, including the meticulous maintenance of accurate and up-to-date insider lists. Failure to comply with MAR can result in significant regulatory penalties and serious reputational damage. By ensuring companies adhere to strict guidelines on handling sensitive information, MAR strengthens investor confidence and market integrity, making compliance an essential part of corporate governance for publicly traded companies.

Inside information is any non-public, precise information about a company or its financial instruments that, if made public, would likely have a noticeable effect on the price of those instruments. Examples include mergers, acquisitions, financial results, major contracts, regulatory approvals, or significant litigation. The definition under MAR requires companies to identify and handle inside information with great care to prevent leaks or unauthorised disclosure. Organisations must carefully assess when information becomes 'inside' and ensure it is managed appropriately, including recording who has access to it and implementing the necessary safeguards to maintain confidentiality until it is formally disclosed to the market.

Unlawful disclosure happens when inside information is shared with an unauthorised person before it has been publicly disclosed, unless it's in the normal course of employment or duty. This includes tipping off friends, family, or business associates, whether intentionally or unintentionally, about upcoming financial results, mergers, or regulatory changes that could affect share prices. MAR requires strict internal controls to prevent leaks and mandates that companies maintain detailed insider lists to track who has access to confidential information. Failing to comply can lead to regulatory investigations, substantial financial penalties, and damage to the reputation of both individuals and the organisation involved in the breach.

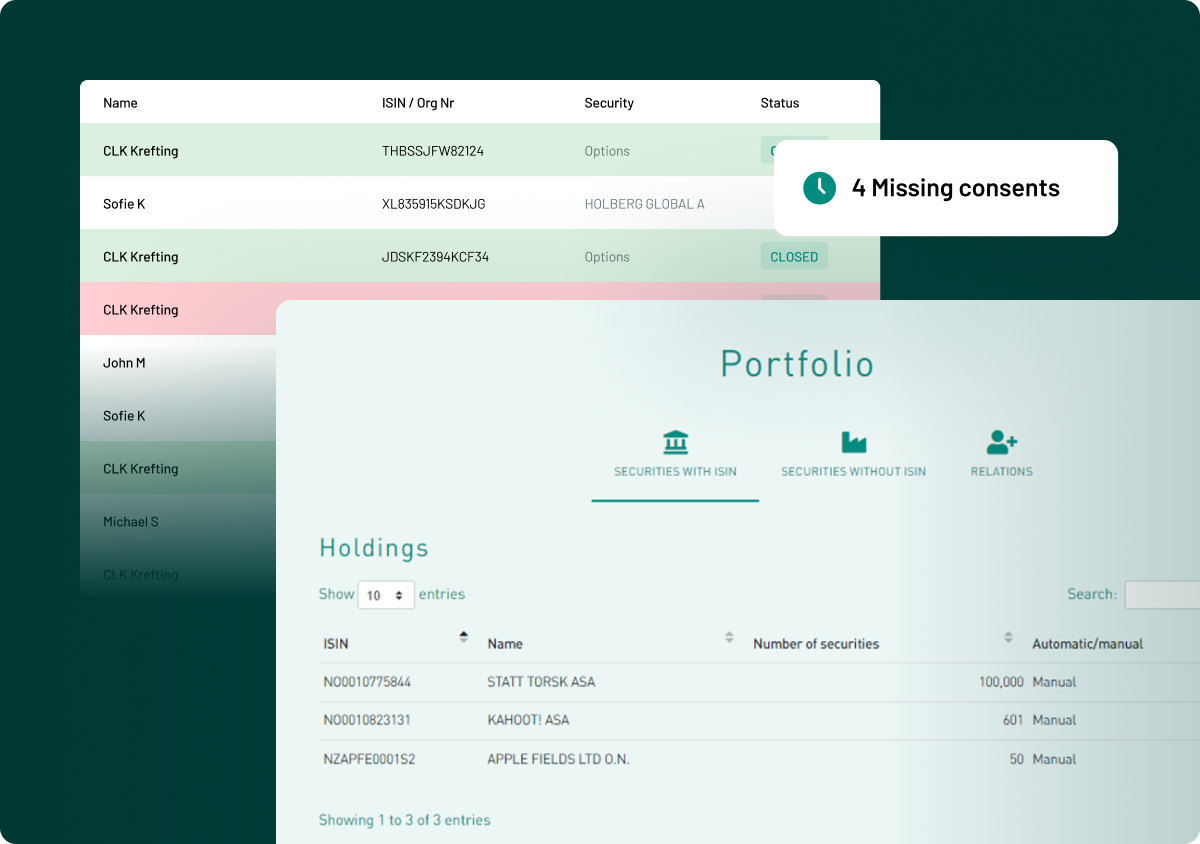

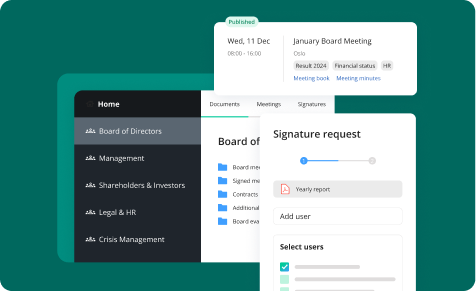

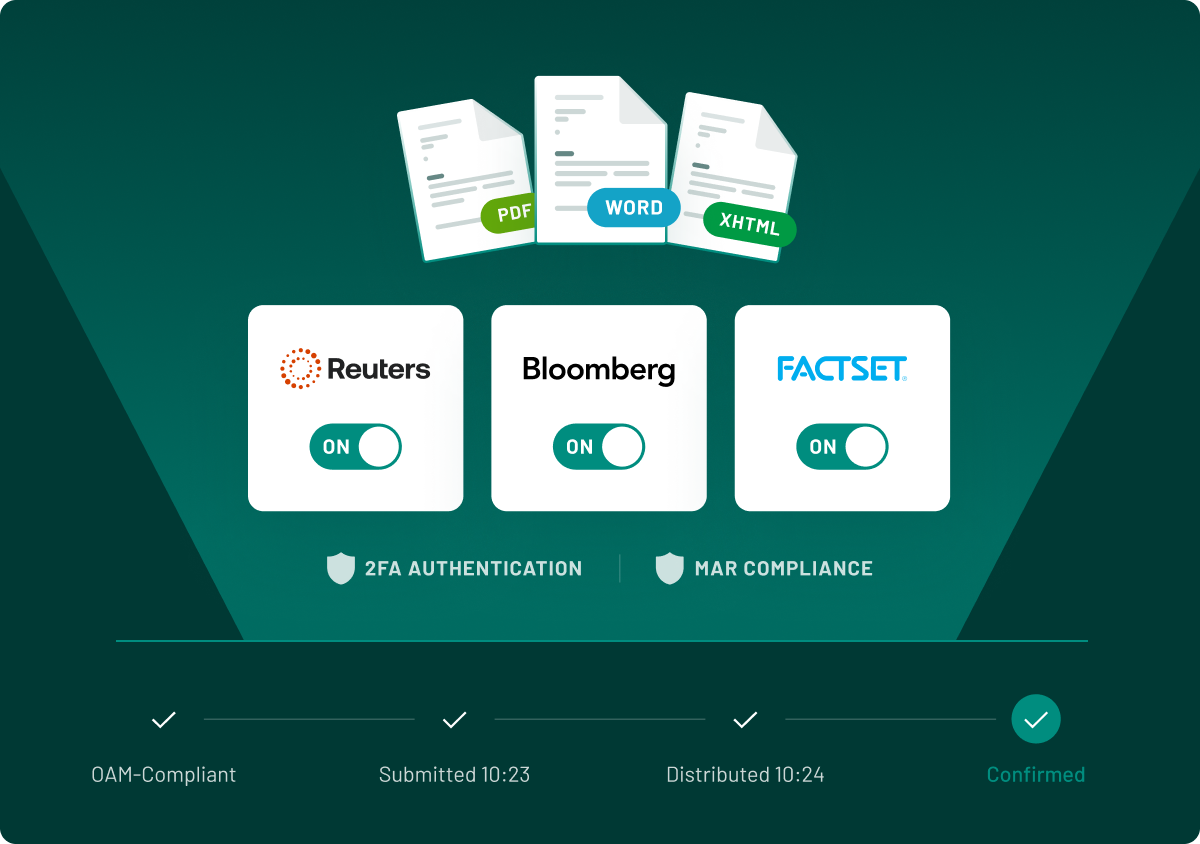

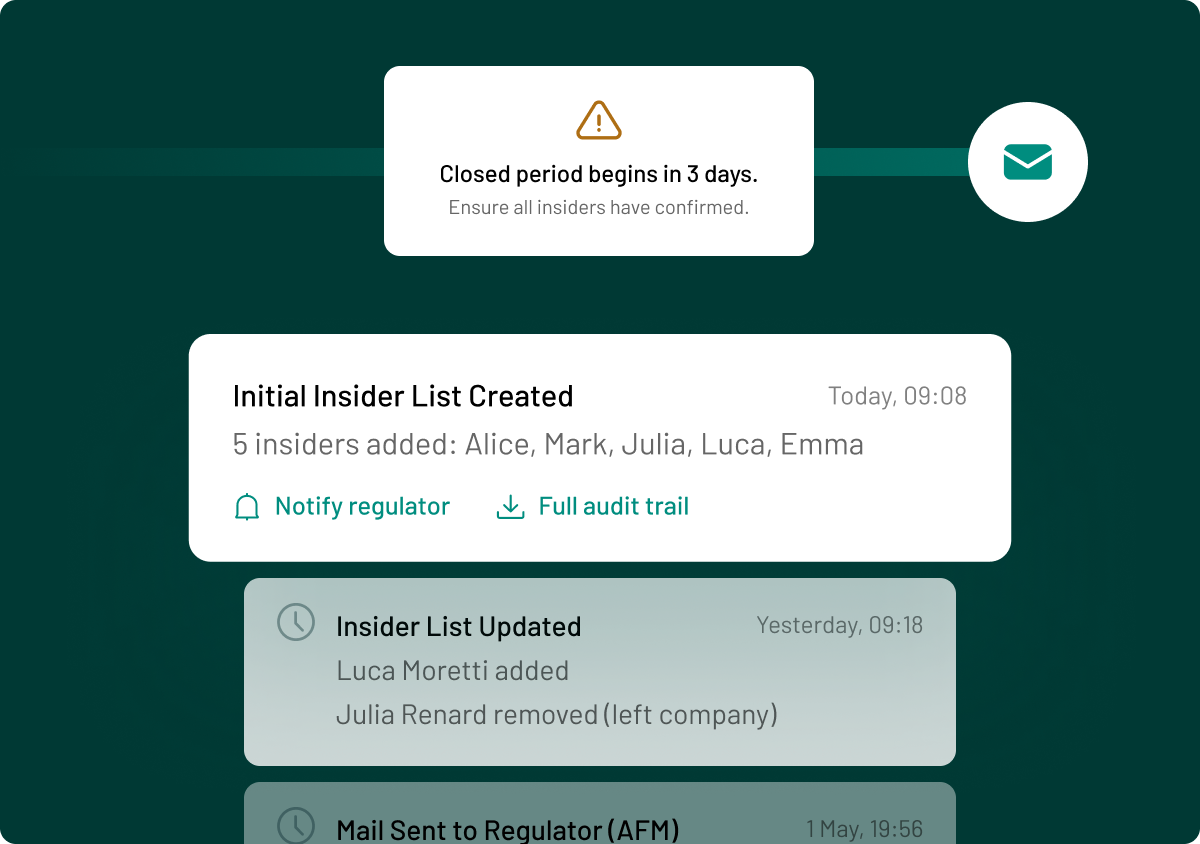

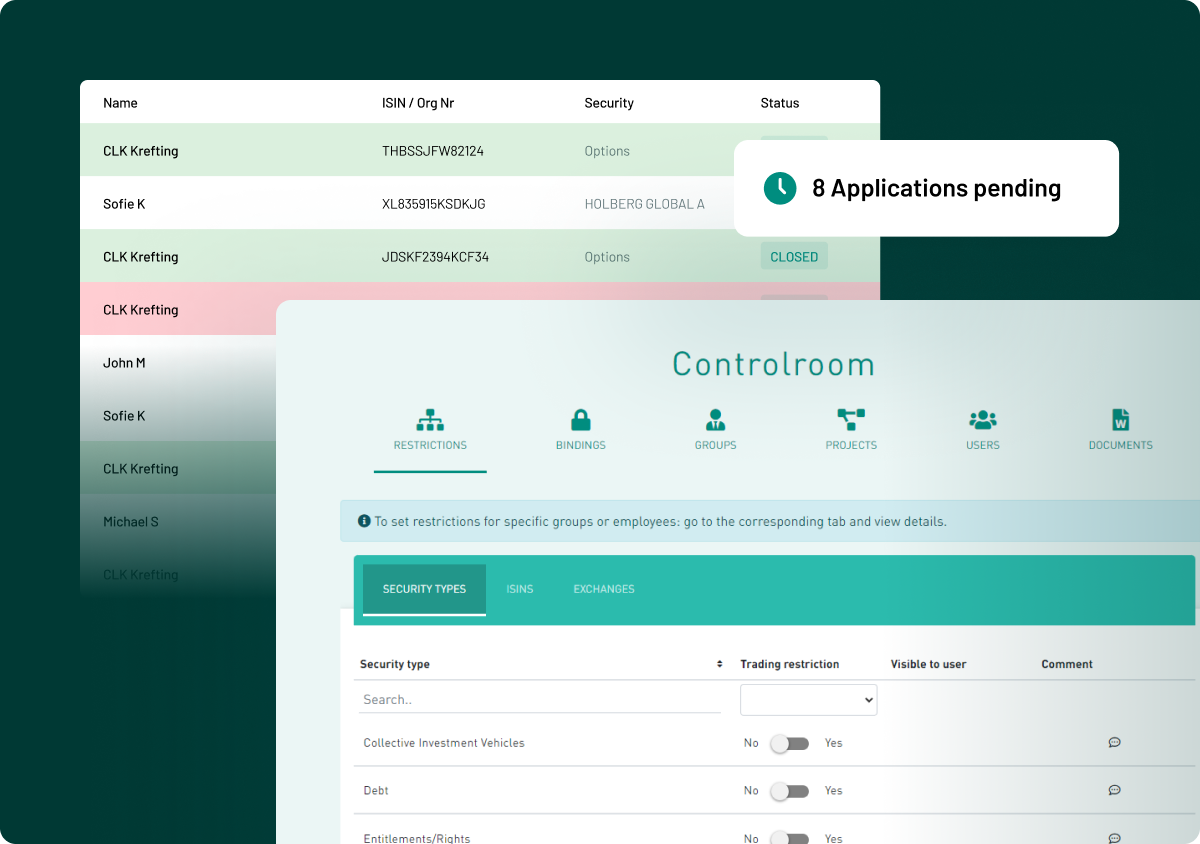

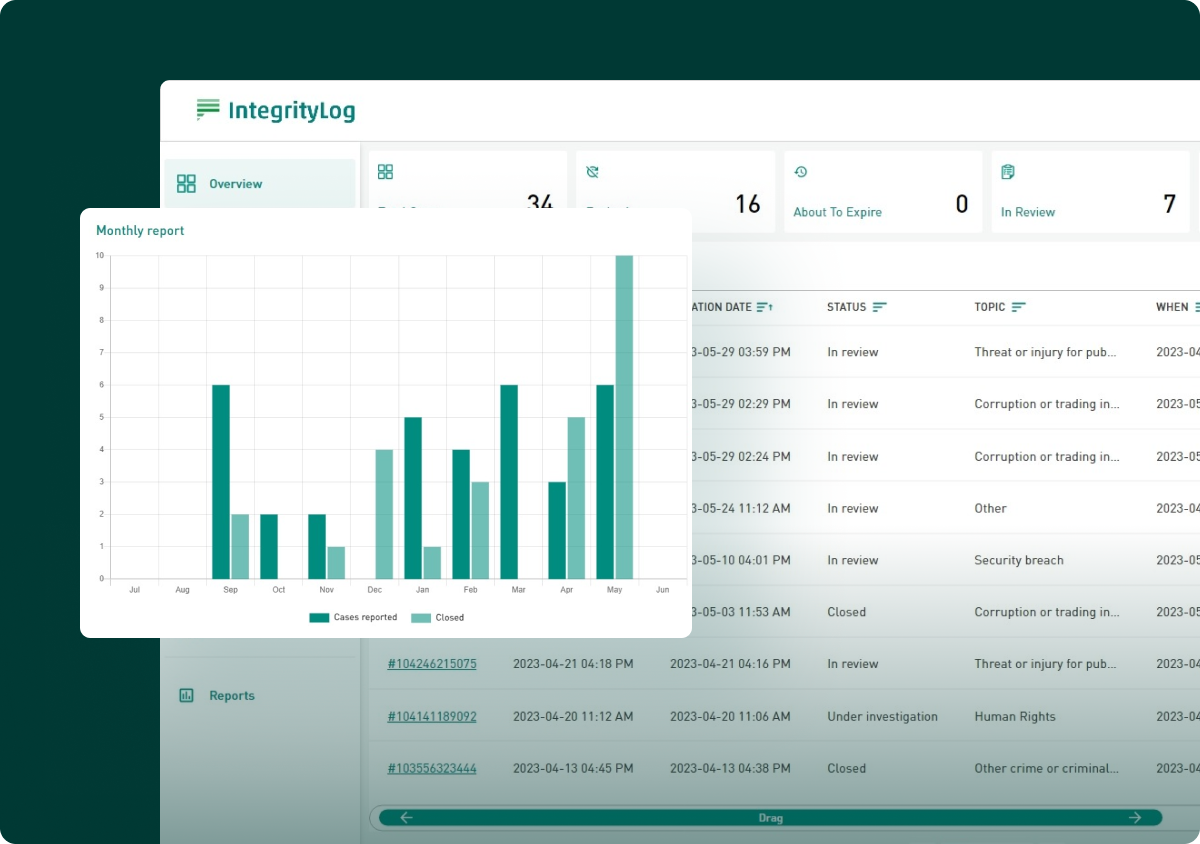

Insider list management software helps companies comply with MAR by automating the creation, maintenance, and updating of insider lists. Unlike manual methods, which are susceptible to human error and inefficiencies, software solutions offer real-time tracking, secure storage, and automated alerts for updates or required actions. These tools also ensure compliance with audit requirements by keeping accurate records of when individuals are added to or removed from insider lists. By reducing the administrative burden and mitigating the risk of non-compliance, insider list software offers greater control, security, and efficiency, helping companies avoid penalties and consistently meet their regulatory obligations.

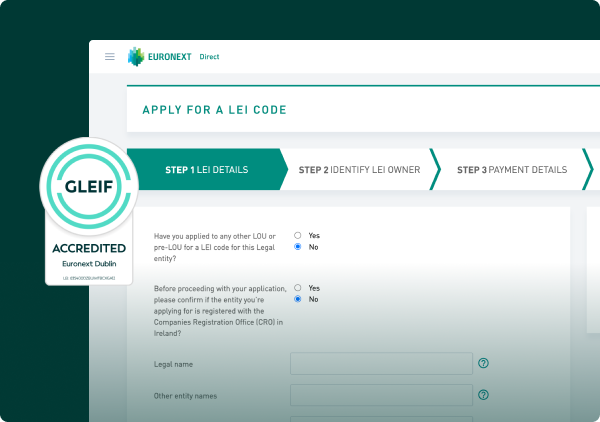

A MAR-compliant insider list must include the names, roles, and contact details of individuals with access to inside information, along with the date and time they were added and removed. Companies must also record the reasons why each person has been included, ensuring clear justifications are available for regulatory review. Insider lists must be kept up-to-date, with prompt additions and removals when individuals gain or lose access to sensitive information. Lists should be securely maintained and readily available for regulatory audits, ensuring transparency and accountability. Software solutions can automate this process, significantly reducing the risk of errors.

Manual methods for managing insider lists, such as spreadsheets, demand considerable administrative effort and are prone to errors, omissions, and inefficiencies. They can lead to compliance breaches because of outdated records or incomplete tracking of insider access. In contrast, software solutions provide automated updates, audit trails, secure access management, and real-time monitoring to ensure compliance with MAR requirements. With built-in reminders and reporting features, software minimises the risks associated with human oversight and provides regulators with transparent, easily accessible records. By improving accuracy, security, and efficiency, software solutions offer a far more reliable and scalable approach to insider list management compared to manual processes.

.png)

.png)

.png)

.png)

.webp)