EBook

MiFID II Compliance Checklist: Everything You Need to Do

This checklist provides the essentials to navigate the complexities of complying with the Markets in Financial Instruments Directive II, offering practical steps for investment firms, market operators, and service providers within the EU. With this checklist, you will gain insights into:

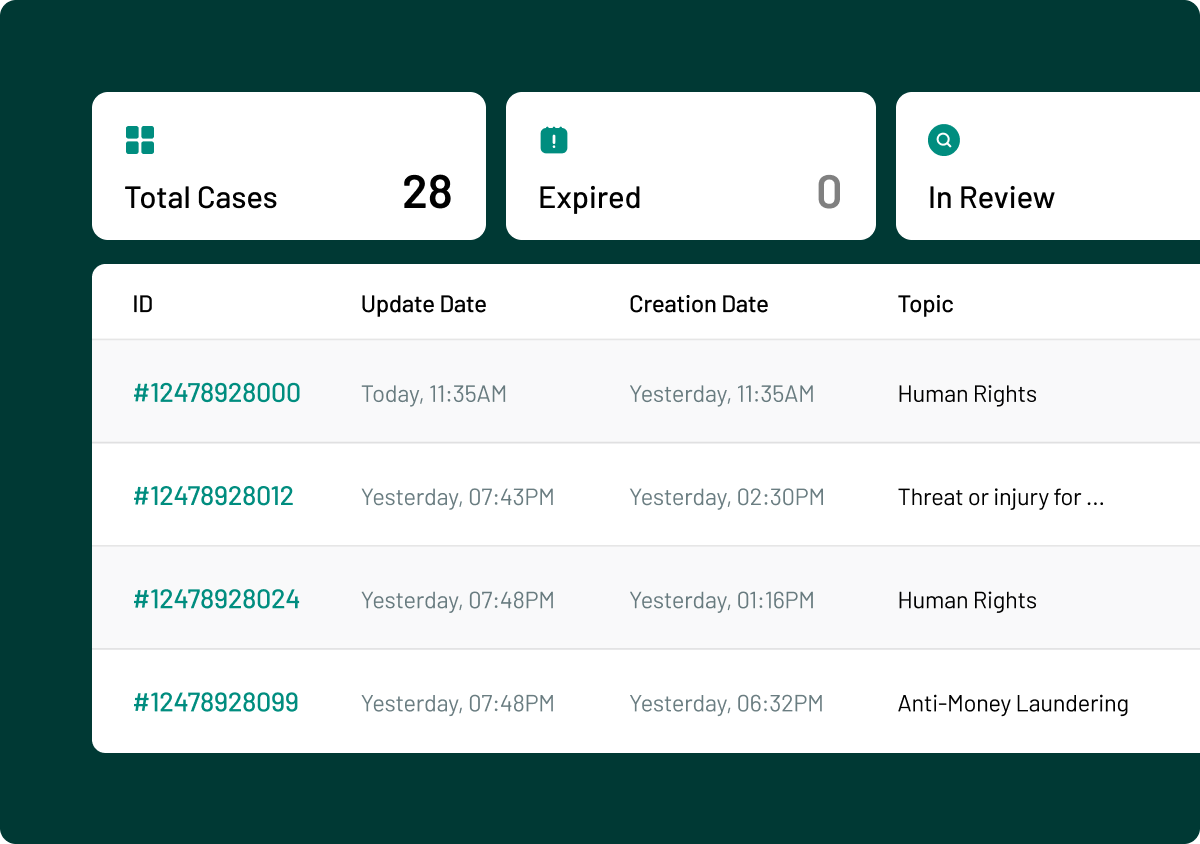

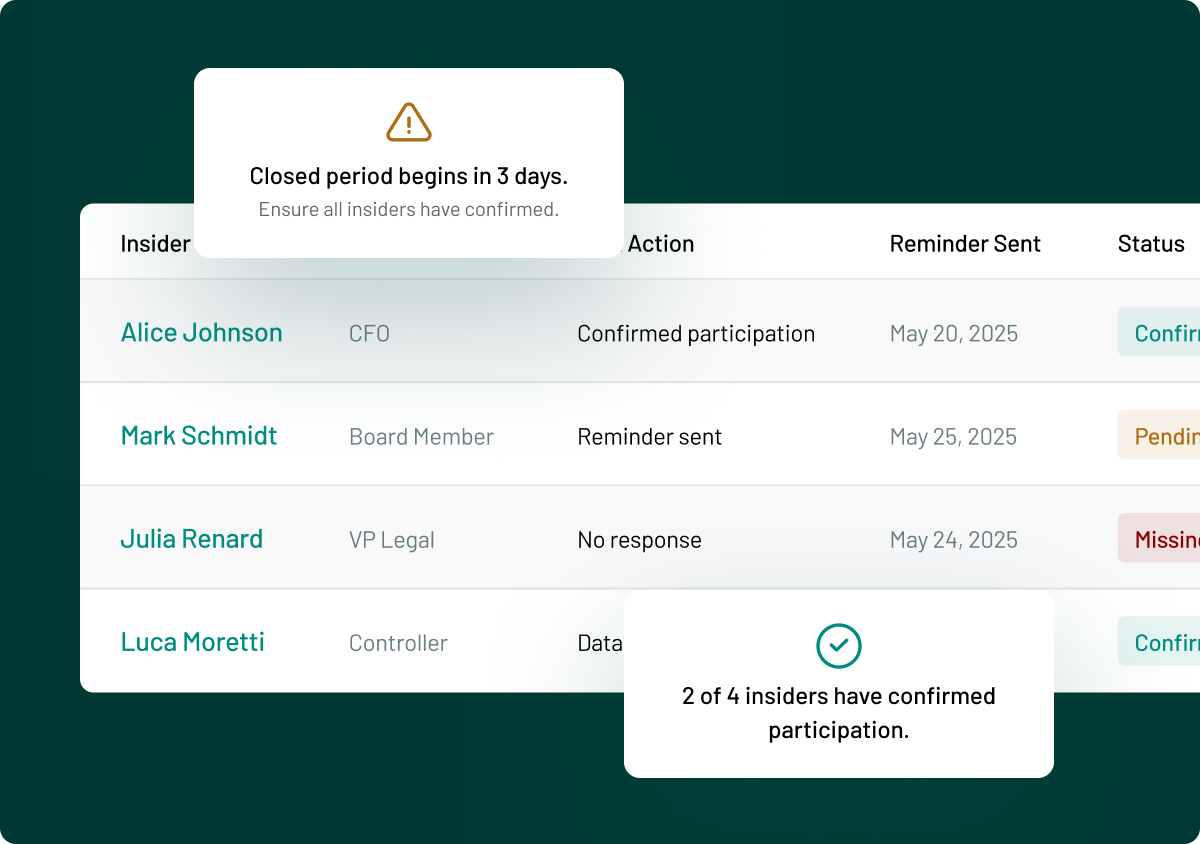

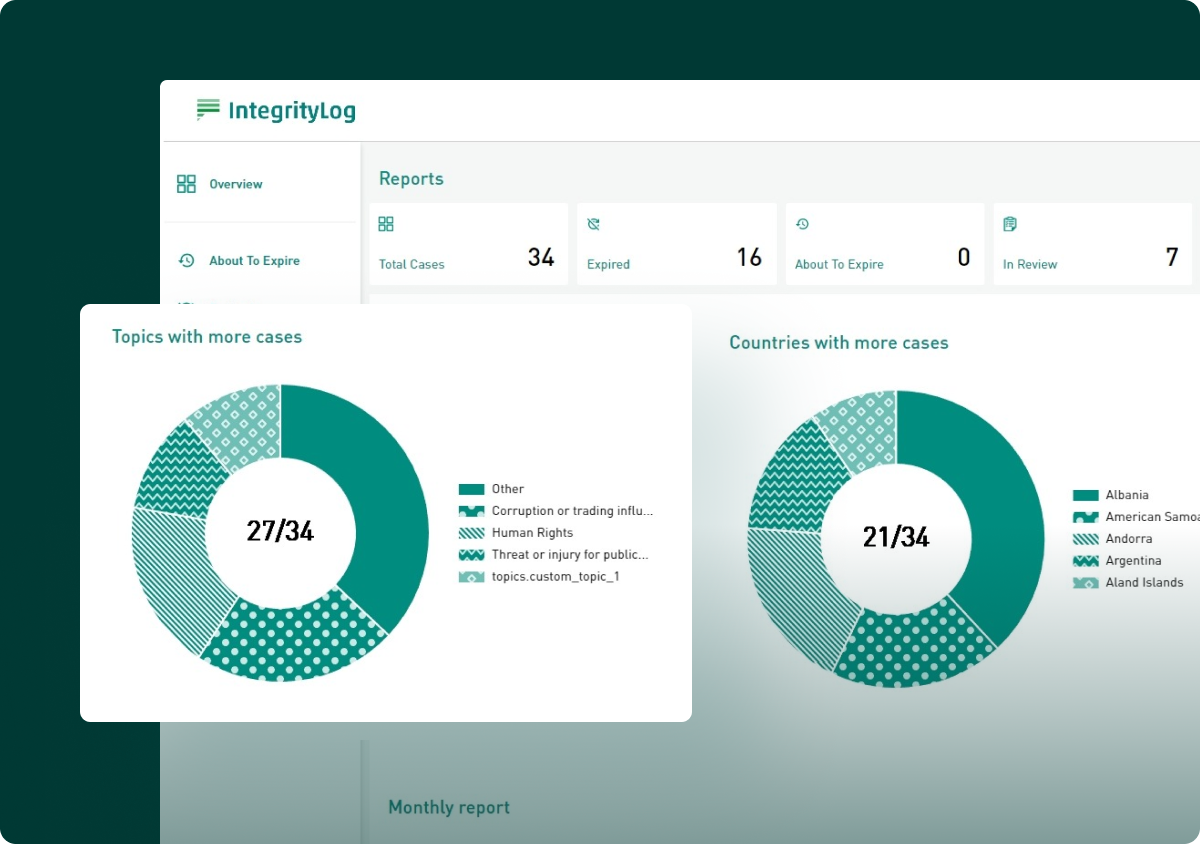

- Comprehensive strategies for preventing market abuse and insider trading

- How to prevent conflicts of interest from happening

- Methods to safeguard investor trust and maintain market integrity

- Key actions to ensure your business meets all MiFID II requirements seamlessly

Equip your organisation with the knowledge and tools needed to achieve full compliance and take the first step towards mastering the Markets in Financial Instruments Directive II.

Download your ebook

What else can you expect from this ebook?

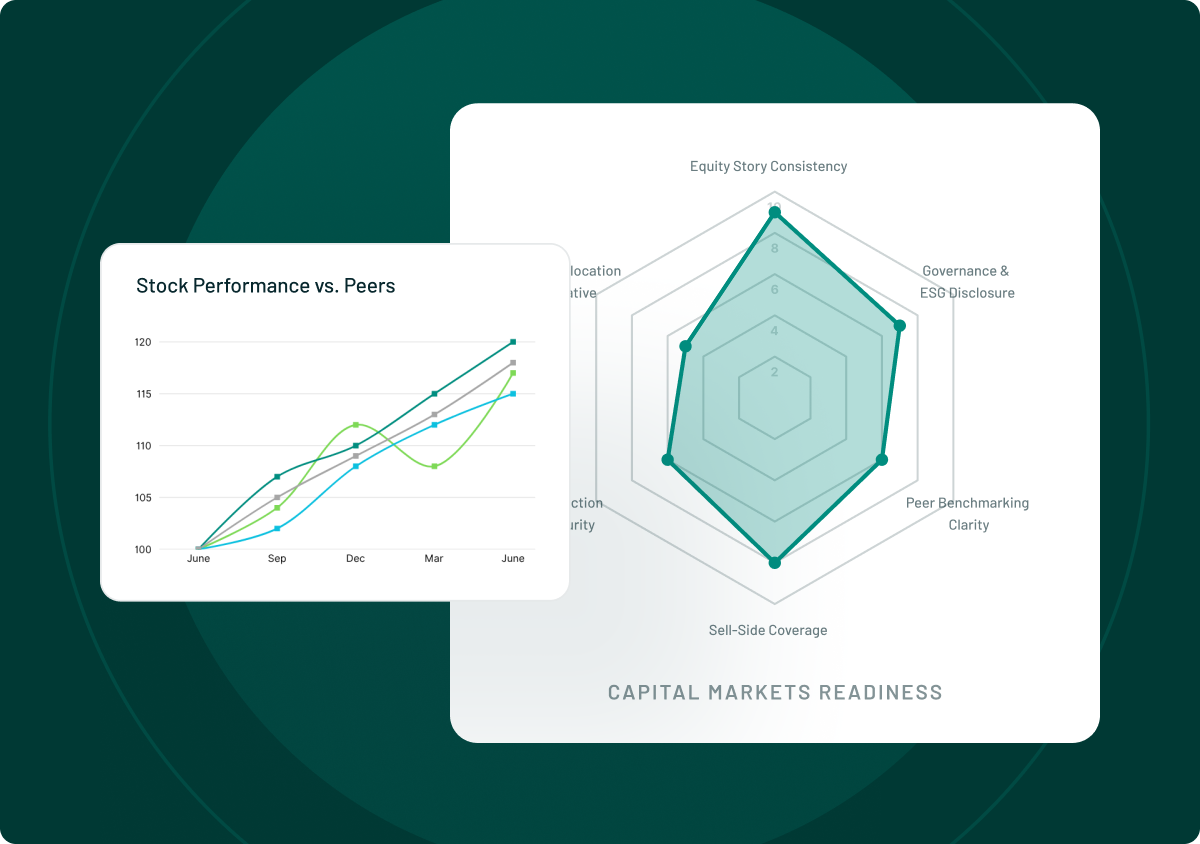

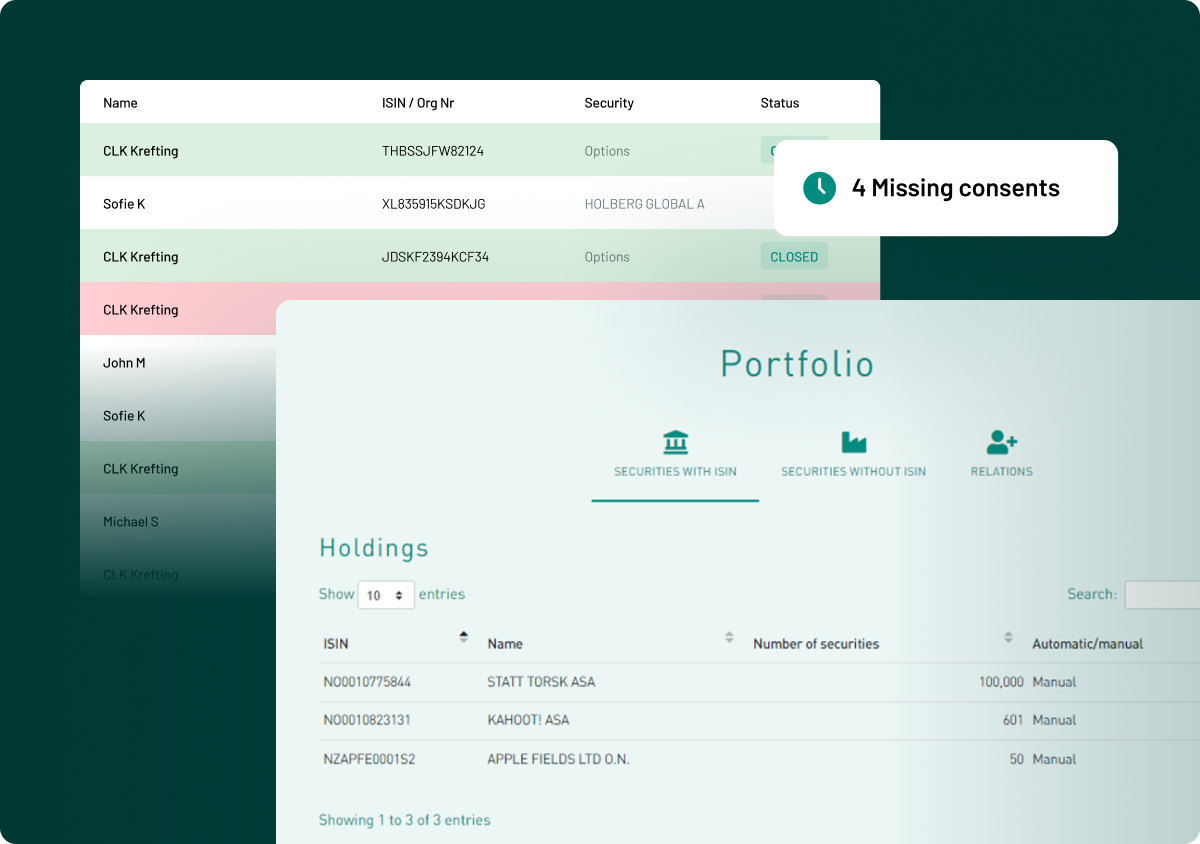

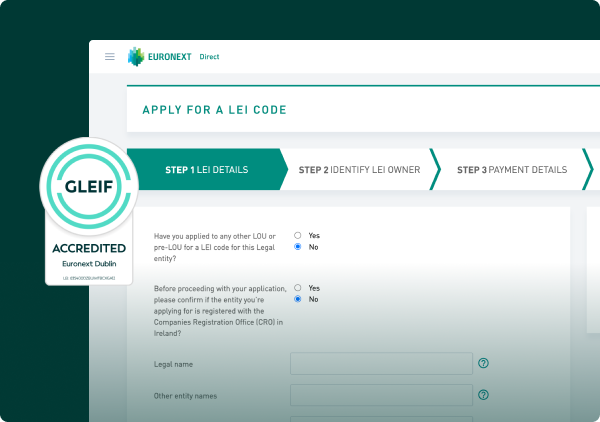

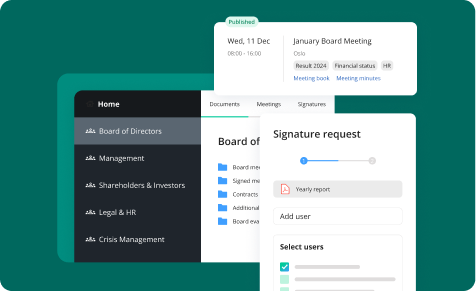

Leveraging tools to support seamless MiFID II compliance

How to strengthen your employee personal trading activity

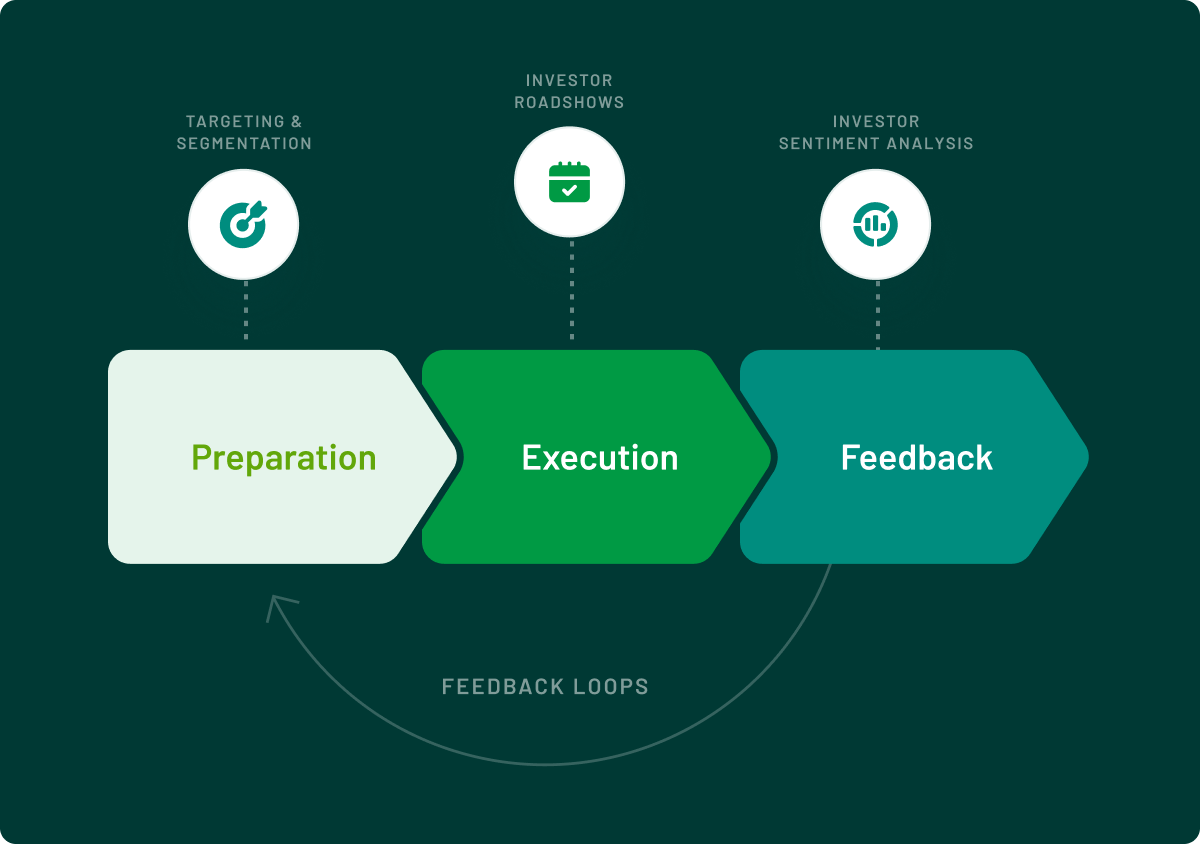

Step-by-step guidance for implementing compliance

Tips for managing expanded regulatory reach to maintain consistent standards

Get your copy of the ebook now

DOWNLOAD NOW

FAQ

MiFID II (the Markets in Financial Instruments Directive II) is a comprehensive piece of EU legislation designed to make financial markets more robust, transparent, and investor-friendly. It aims to strengthen investor protection and improve how markets function. Why does it matter? Because non-compliance can lead to hefty fines and serious reputational damage. It's about ensuring a level playing field and restoring trust in the financial system. The directive sets out requirements in a wide range of areas such as trade reporting and best execution.

MiFID II's reach is broad, encompassing a wide range of financial institutions operating within the EU. This includes investment firms, banks, asset managers, and trading venues. Crucially, even if your firm is based outside the EU, you may still need to comply if you provide services to EU clients or trade on EU markets. Essentially, if you're involved in providing investment services or executing financial transactions that touch the EU, you need to understand your obligations.

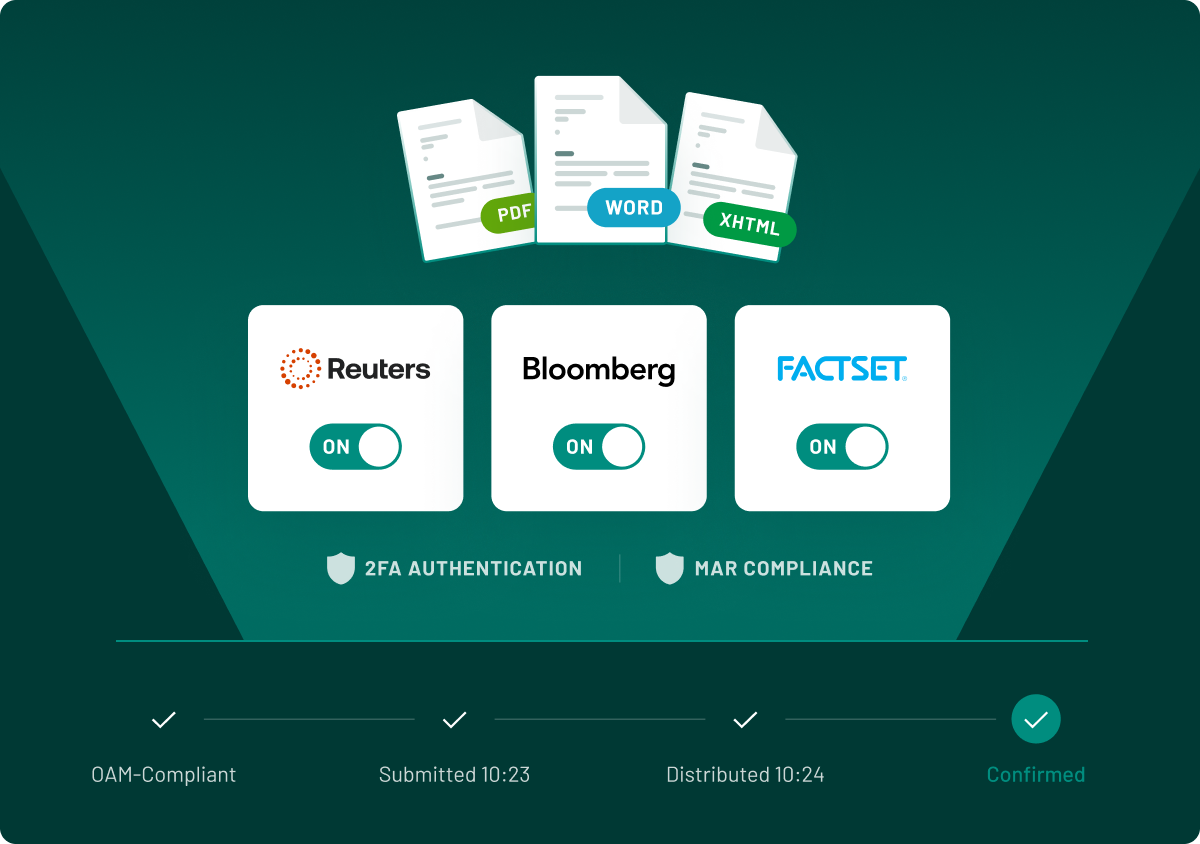

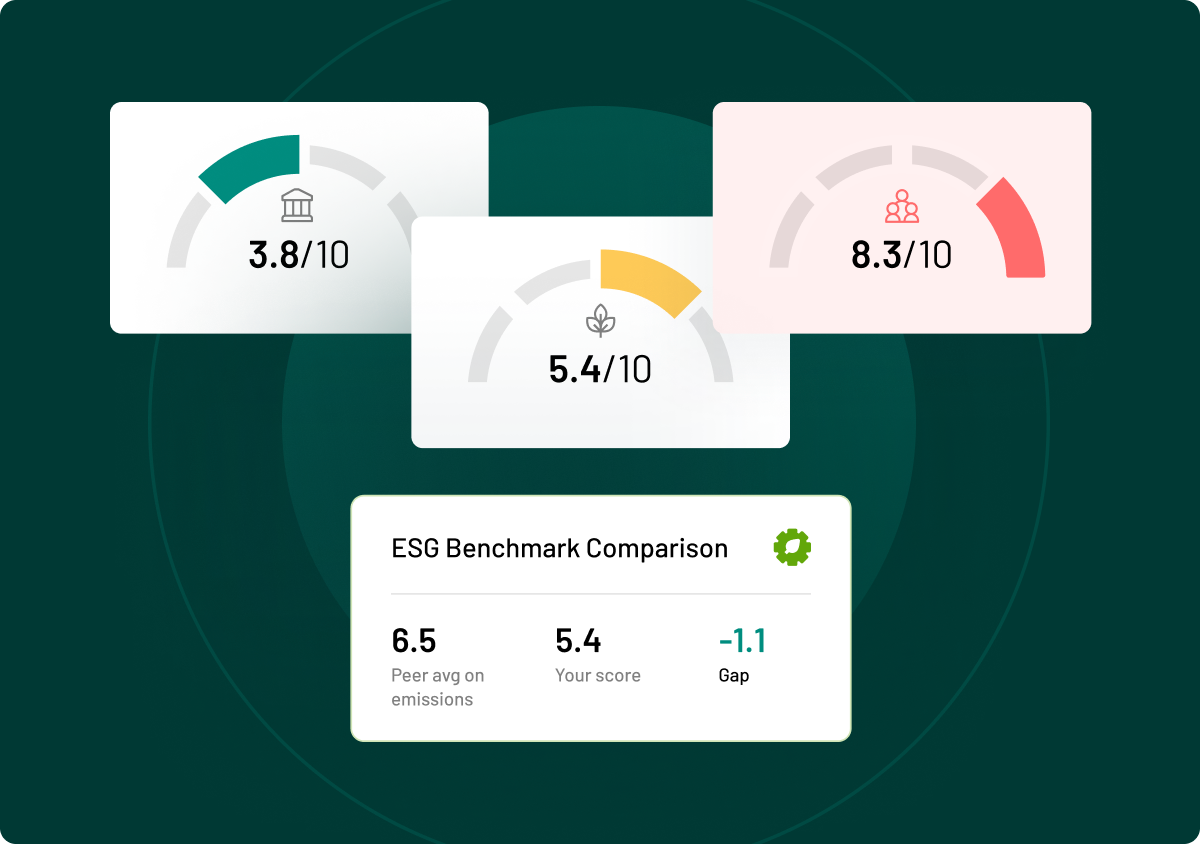

MiFID II sets out a number of key requirements. These cover things like trade reporting, making sure investors are properly protected, ensuring best execution of trades, product governance, and meticulous record-keeping. Firms need to provide clear, fair, and not misleading information to clients, properly assess the suitability of financial products, and ensure trades are executed transparently and fairly. There are also strict obligations around reporting transaction data to regulators. A robust internal framework for governance, risk management, and compliance monitoring is absolutely vital.

The consequences of non-compliance with MiFID II are severe. Financial regulators across Europe have the power to impose substantial fines, which can run into millions of euros. Beyond the financial penalties, firms could face trading restrictions, have their licences revoked, or be subject to increased regulatory scrutiny, all of which can severely impact operations. Furthermore, non-compliance erodes trust with investors and clients, potentially leading to significant business losses and lasting reputational damage.

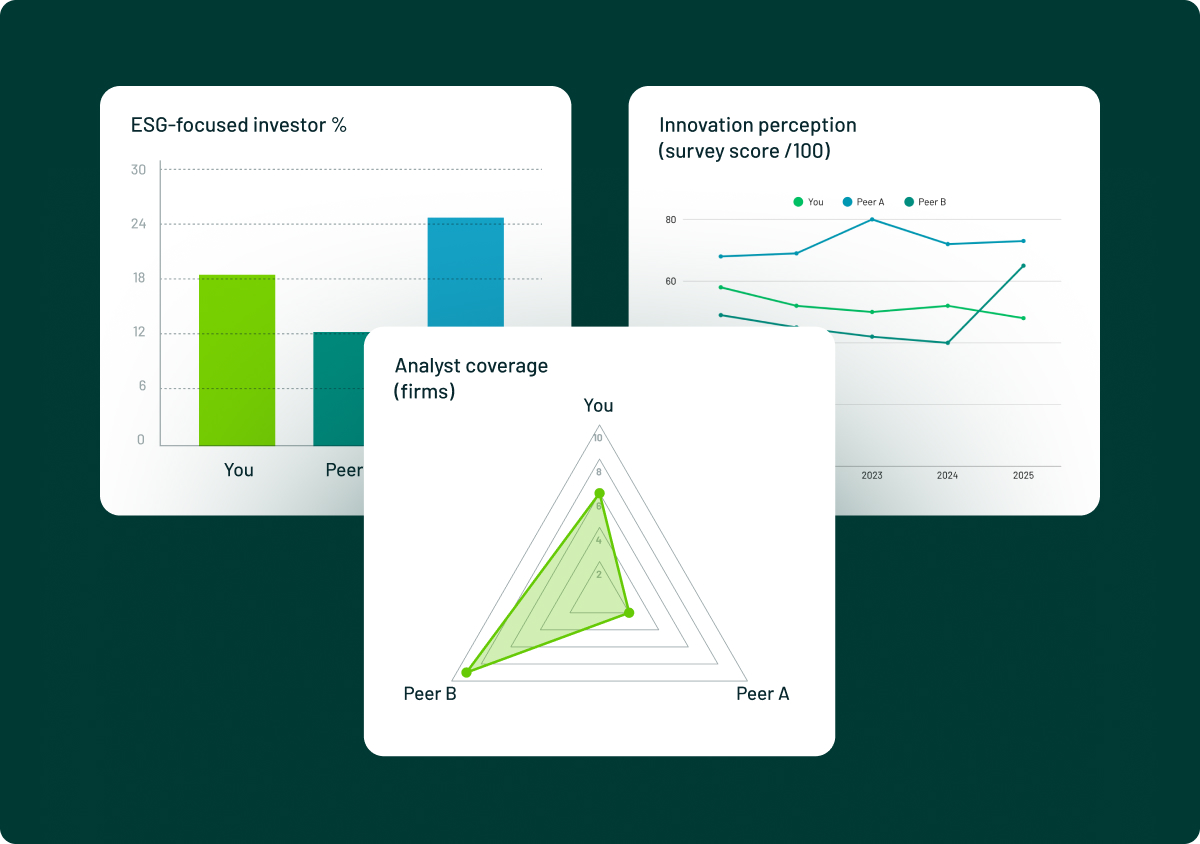

A MiFID II Compliance Checklist is your essential guide to navigating the complexities of this regulation. It provides a comprehensive framework, setting out the key obligations you need to meet – from transparency measures and investor protection rules to transaction reporting and governance requirements. Think of it as a roadmap, ensuring you don't miss any crucial steps. By using the checklist, your firm can pinpoint any gaps in your current processes, put the necessary controls in place, and streamline your overall compliance efforts. Whether you're gearing up for a regulatory audit or simply looking to strengthen your internal procedures, this checklist is a practical tool to help you stay on the right side of MiFID II and avoid those potentially hefty penalties.

Yes, absolutely. MiFID II has extra-territorial reach. If your firm, even if based outside the EU, offers investment services to EU clients or trades in EU financial markets, you're likely to be affected. Many non-EU firms need to comply with MiFID II's "third-country" rules, which might involve registering with EU regulators and meeting specific standards for transparency and investor protection. Even for firms engaging in cross-border transactions, aligning with MiFID II's reporting and governance obligations may be necessary. It's crucial to understand how MiFID II applies to your specific circumstances to avoid regulatory issues.

.png)

.png)

.png)

.png)

.webp)