CHECKLIST

Managing capital markets compliance in turbulent times

This checklist lets you explore the key aspects you need to cover for a capital markets compliance during turbulent times.

You will see which points you need to consider in order to comply with the regulatory requirements of Market Abuse Regulation, Markets in Financial Instruments Directive II, and the EU Whistleblowing Directive.

Capital markets are now under pressure due to the US import tariffs on goods from around the world. This is an example of how geopolitical disruptions can lead to market volatility, making it essential for European companies to stay compliant. During turbulent times like these, regulatory compliance has never been more critical, and businesses must ensure they meet all requirements of MAR, MiFID II, and the EU Whistleblowing Directive to maintain a fair and secure trading environment.

Regulators turn to legislation to maintain a safe and fair environment in the capital markets, especially when they face significant disruptions. While this can create administrative and financial burdens for businesses, this ebook will show you how to simplify the processes for capital market compliance.

Download your ebook

Fill out the form to get in touch with our sales team.

What else can you expect from this checklist?

How can you avoid risks related to capital market compliance

Be ready to prevent market abuse

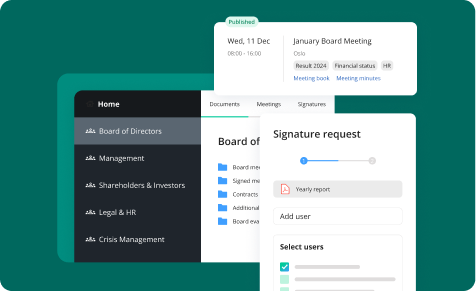

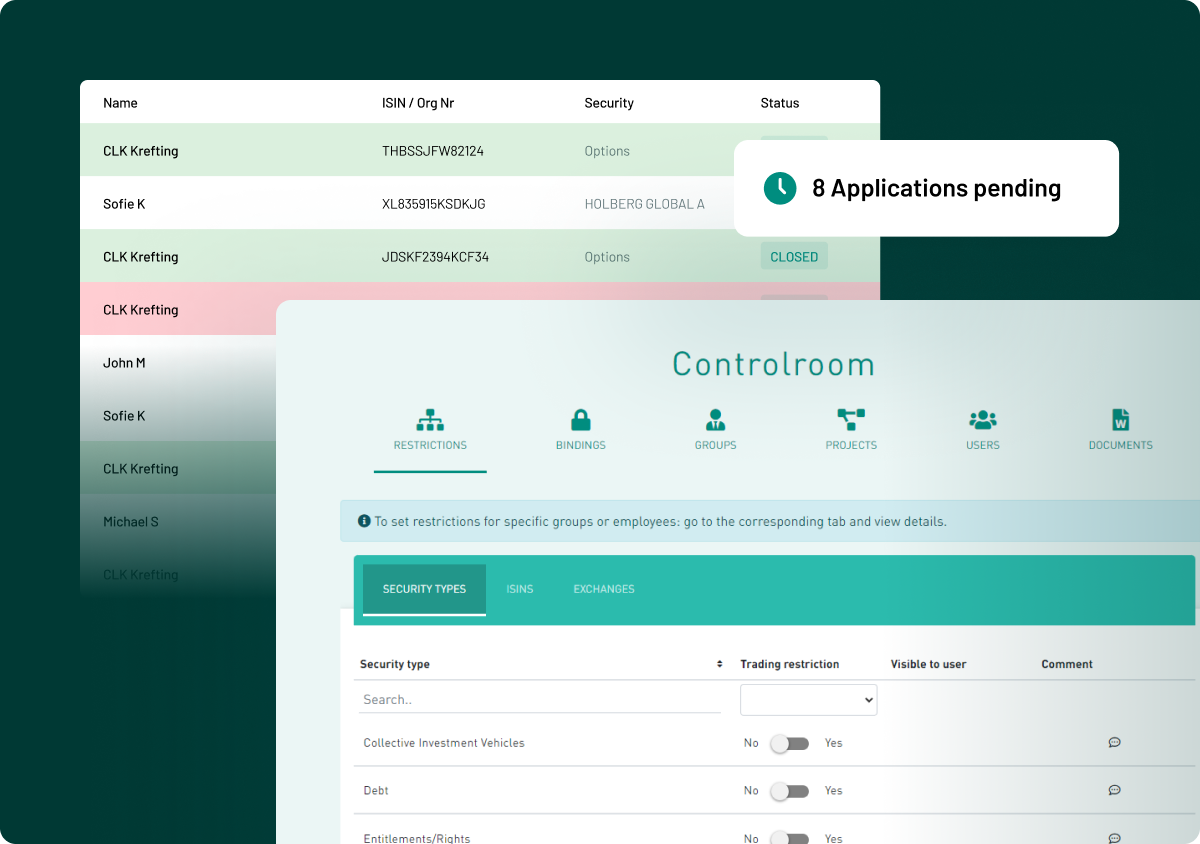

Key aspects for compliant employee personal trading

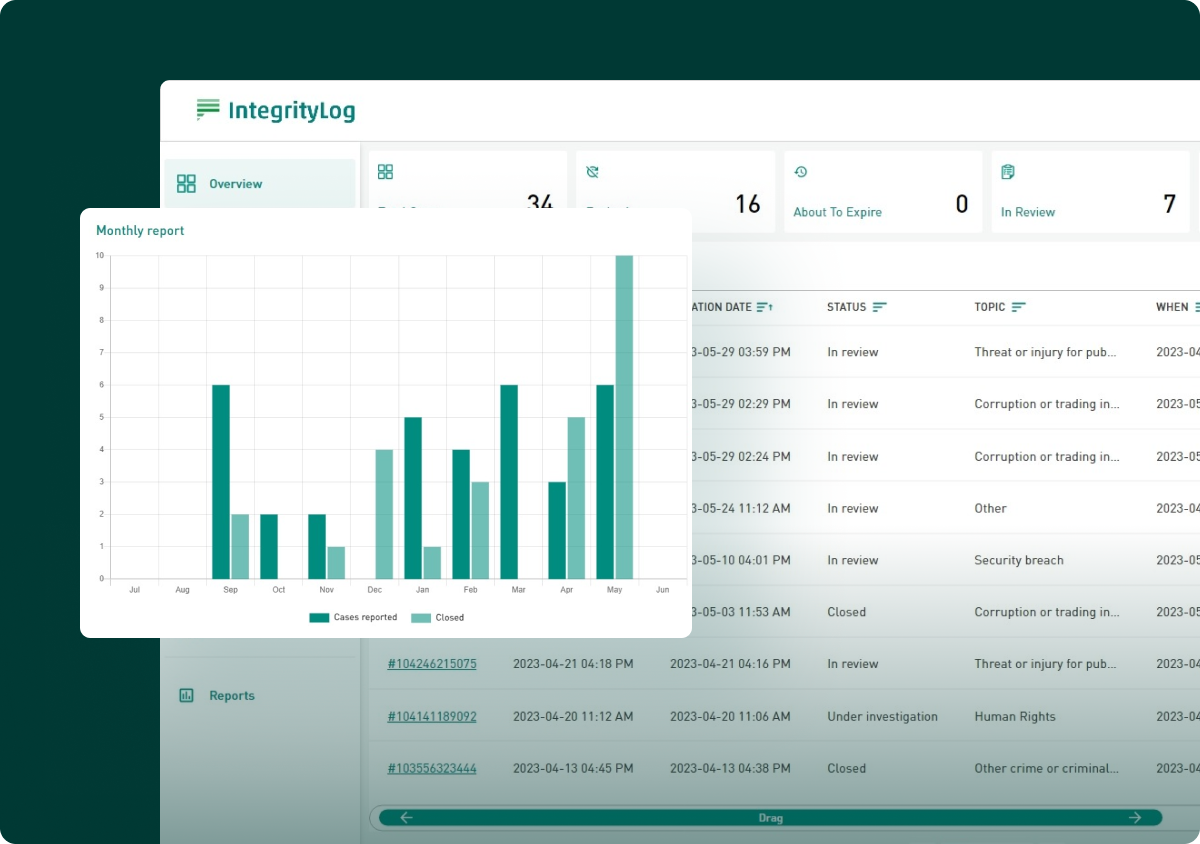

Build a speak-up culture that ensures confidentiality

FAQ

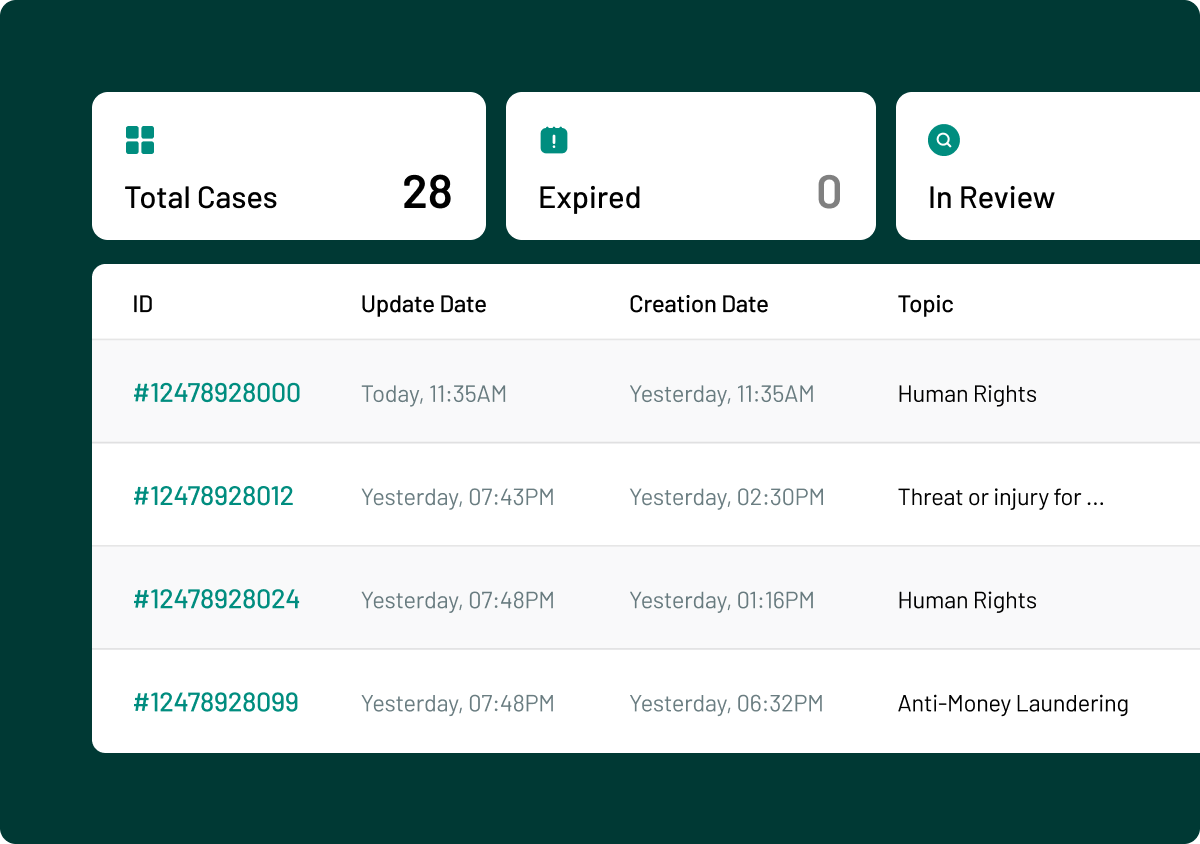

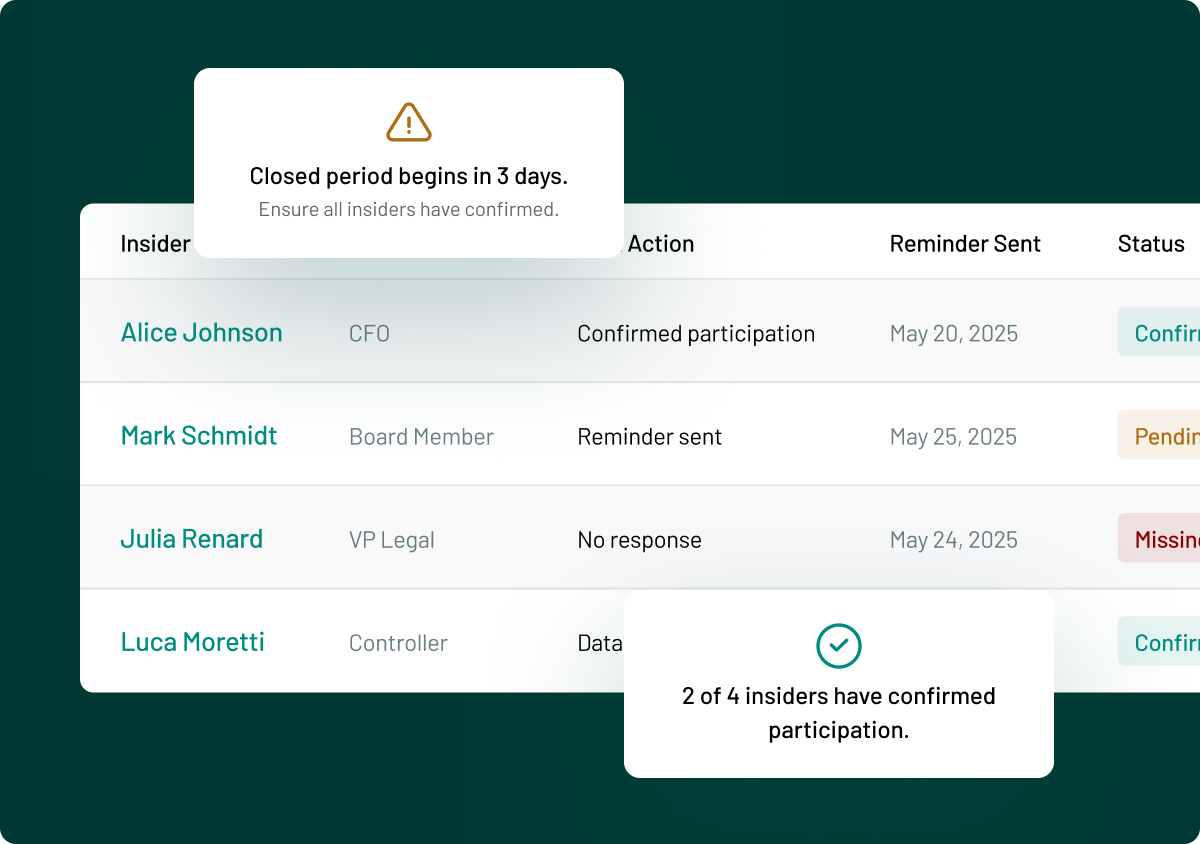

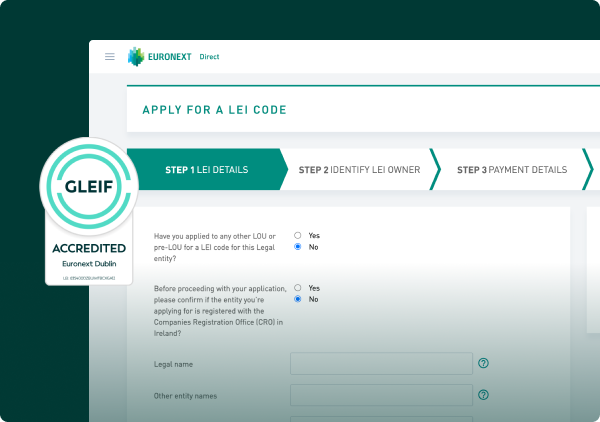

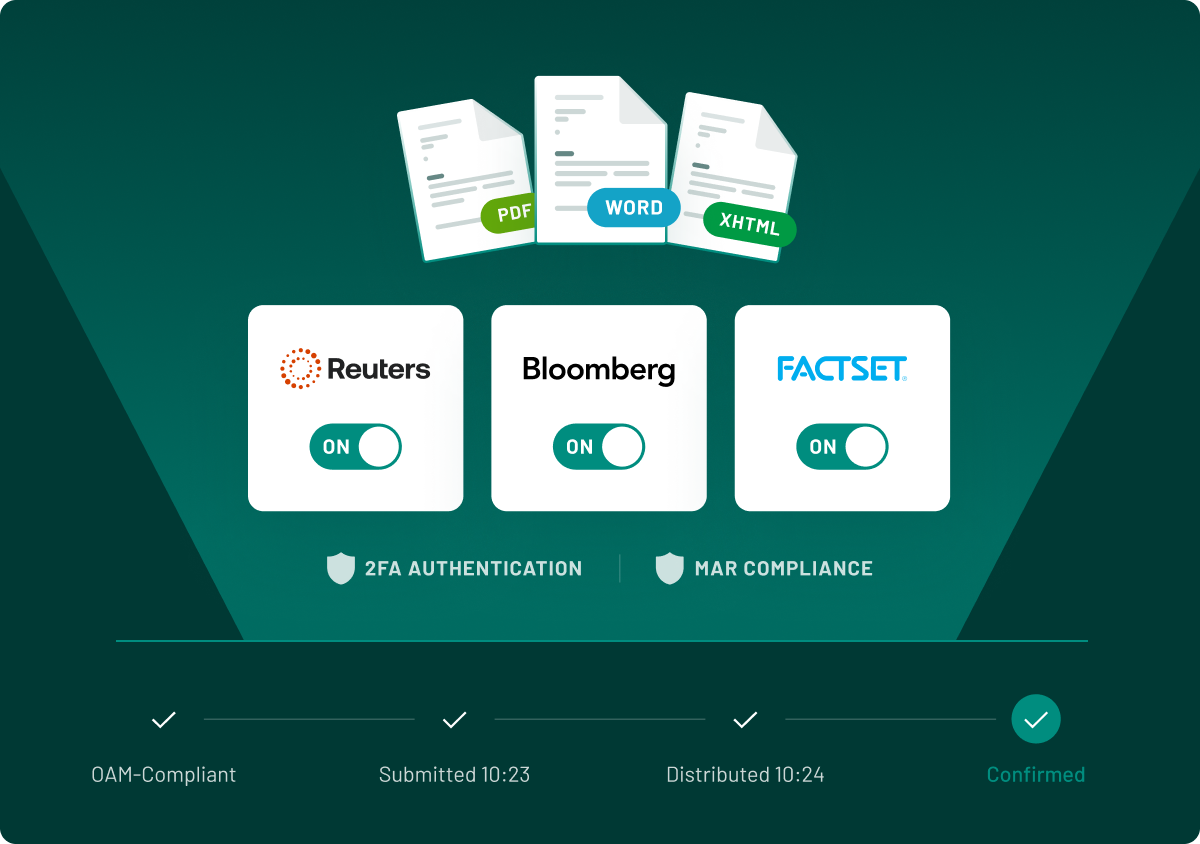

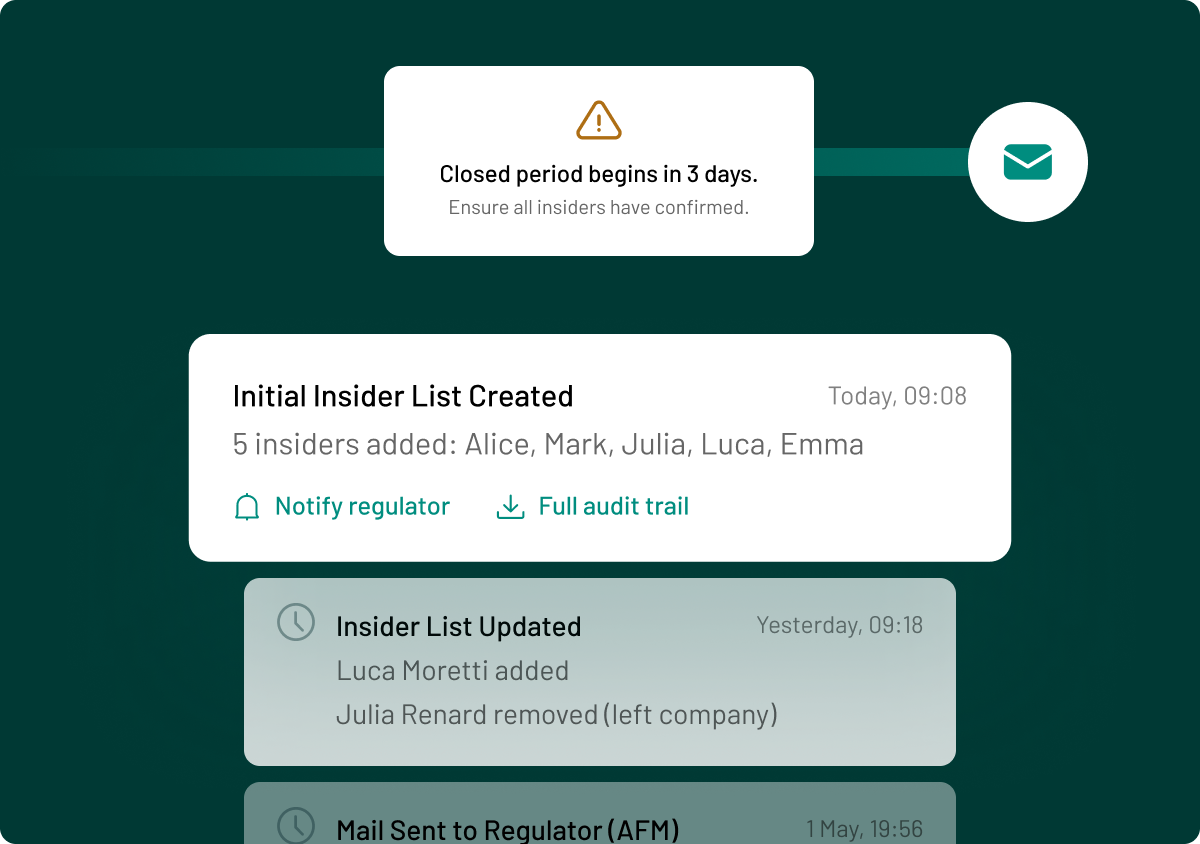

The Market Abuse Regulation (MAR) is a crucial piece of EU legislation designed to maintain fair and transparent financial markets. It does this by preventing insider dealing, market manipulation, and the unlawful disclosure of inside information. MAR applies to all listed companies, requiring them to put in place robust compliance procedures, including the meticulous maintenance of accurate and up-to-date insider lists. Failure to comply with MAR can result in significant regulatory penalties and serious reputational damage. By ensuring companies adhere to strict guidelines on handling sensitive information, MAR strengthens investor confidence and market integrity, making compliance an essential part of corporate governance for publicly traded companies.

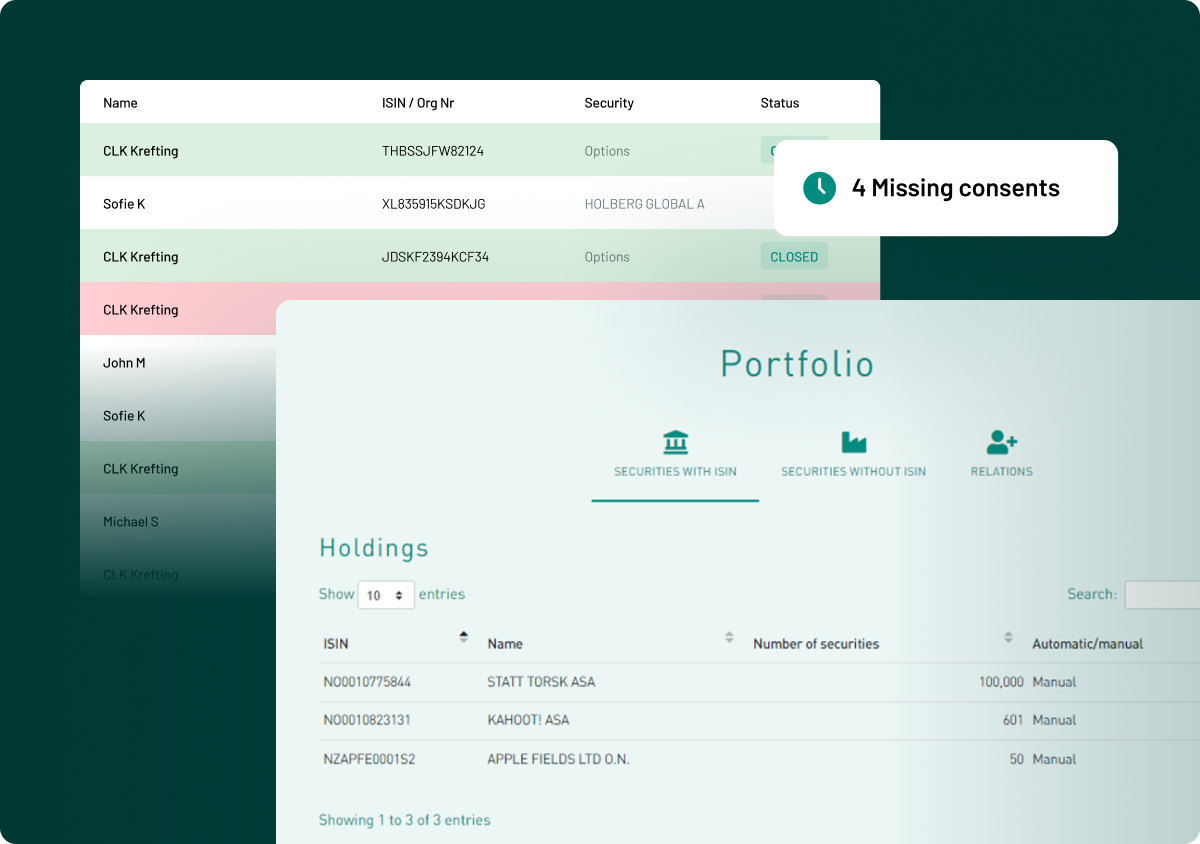

MiFID II (the Markets in Financial Instruments Directive II) is a comprehensive piece of EU legislation designed to make financial markets more robust, transparent, and investor-friendly. It aims to strengthen investor protection and improve how markets function. Why does it matter? Because non-compliance can lead to hefty fines and serious reputational damage. It's about ensuring a level playing field and restoring trust in the financial system. The directive sets out requirements in a wide range of areas such as trade reporting and best execution.

If your country is an EU member, then yes! The EU Whistleblowing Directive is designed to protect individuals who report breaches of EU law, ensuring their safety from retaliation. It applies to both private and public sector organizations with 50+ employees, and companies must implement secure channels for whistleblowers to report wrongdoing confidentially.

Geopolitical events, such as the news about US tariffs imposed by Donald Trump, the war in Ukraine, rise of inflation, or shifting trade policies, can significantly affect the stability of capital markets. These developments introduce increased market volatility and uncertainty. During such times, it’s crucial for businesses to stay compliant with regulatory frameworks, capital market regulations, and risk management protocols to navigate challenges and protect against potential financial and legal risks.

The changes in capital markets mean businesses must be more vigilant than ever in maintaining compliance. In a time of increased uncertainty, non-compliance can lead to severe reputational damage and sanctions, which can destabilize your company. Staying compliant helps protect your organization from these risks, ensuring you remain trustworthy and resilient despite external pressures.

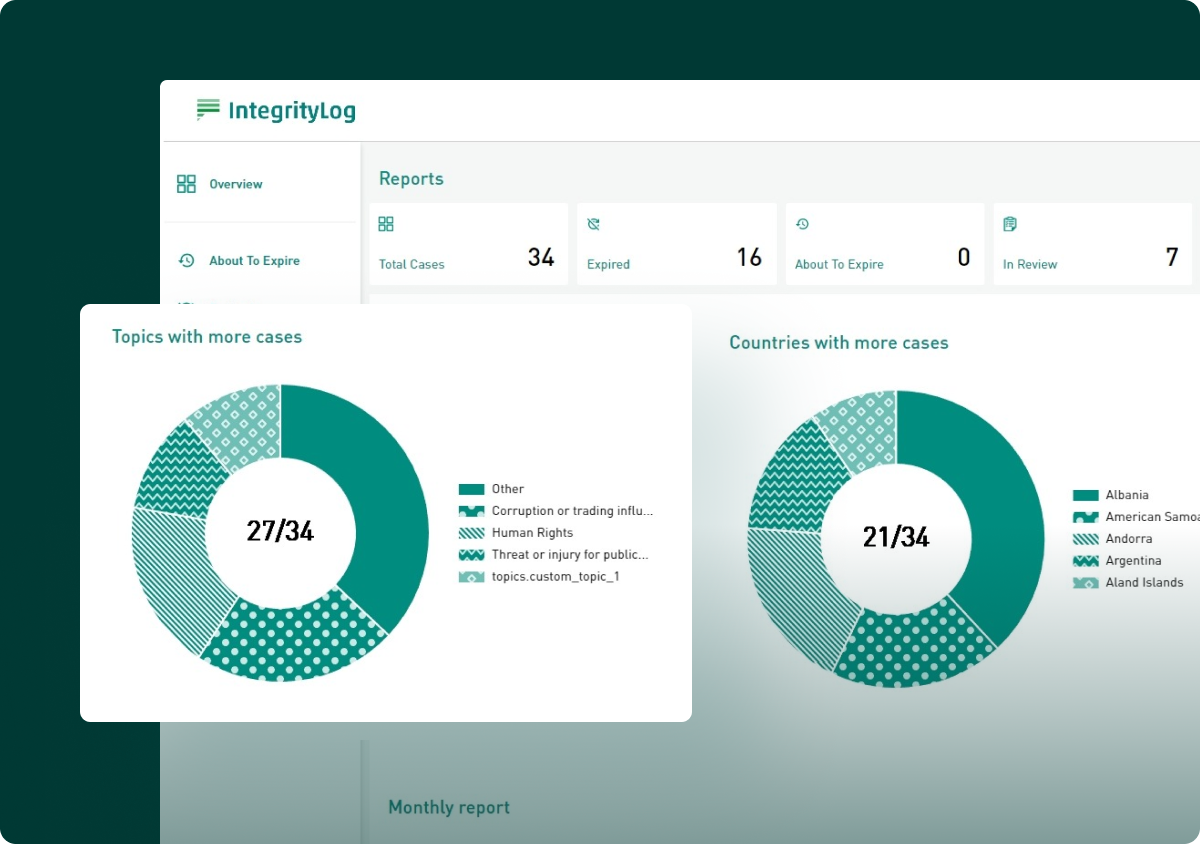

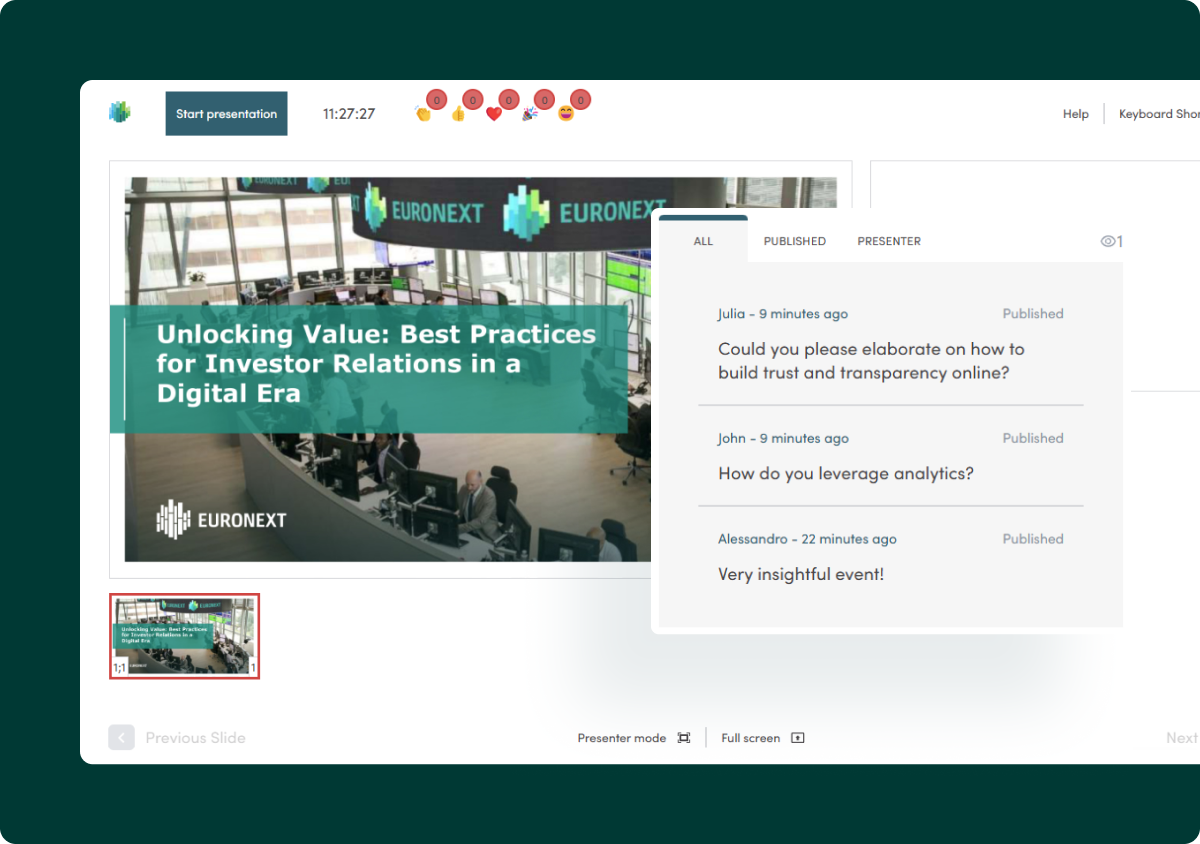

Even during difficult times, like an economic downturn, ComplyLog's solution can help you meet your compliance needs for MAR, MiFID II, and the EU Whistleblowing Directive in an easier, faster, and more efficient way. Including all the tools you need to stay compliant, our solutions ensures you can navigate complex regulations and maintain confidence, even in uncertain market conditions.

.png)

.png)

.png)

.png)

.webp)